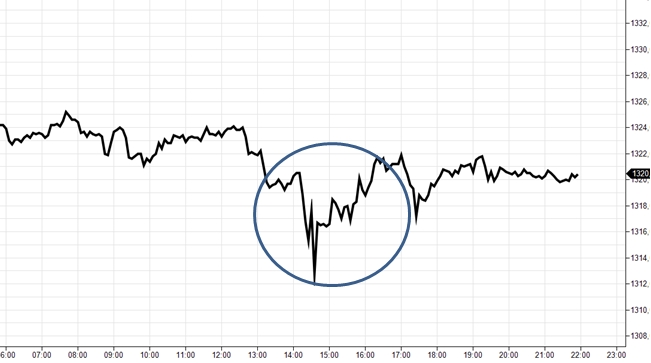

This strategy is based on the expectation that the price of gold often moves quickly up or down, after which the price levels out again within a few minutes or at most 1-2 hours. We’ve named the strategy “Fakemove” because these movements in gold can be considered “fake moves” – precisely because they are offset again shortly afterward. If you look at the gold price on a 1-minute chart, you will clearly see these short movements (up or down) that occur at least 2-3 times a day. The idea behind the strategy is to exploit these “fake moves” and precisely buy or sell gold in the opposite direction when the quick movement is over.

| Try our free forex signal service via Messenger: Click here |

Typically, a “fake move” in the price of gold involves a rapid downward movement, after which the price recovers the entire drop. Such movements are the target of this strategy.

For a “fake move” to be tradable, we have defined a set of parameters that need to be met. Below, you’ll find a set of parameters that have proven to be profitable in various periods. However, you should be aware that the market is in constant motion, and the parameters may often need to be adjusted based on market conditions.

Entry: 45-55% of the entire move

Target: 100-110% of the move

Stop: 1 tick above/below the reversal

Minimum size of fake move: 3 points

Maximum size of fake move: 12 points

Duration of the entire fake move: Up to 110 minutes

Price movements before the fake move: Look back 110 minutes

Price movements before the fake move must not be larger than: 10% of the entire fake move’s movement.

Exit the trade if the target is not reached after: 120 minutes.

Traded in the time frame: 09:00-13:30, CET.

The above illustrates a typical setup for a potential “fake move” in the price of gold. The chart does not specify the price, but the movement is approximately 6 points. To initiate the trade, the price needs to fall below 50% of the total movement. The strategy works best when you are not in the midst of a trending market where the price rises or falls significantly over several days.