Currency trading is often referred to as forex or FX trading.

If you have not heard of currency trading before, it is essential that you read this article thoroughly. Even if you don’t understand all the concepts 100%, it’s important to be familiar with them. If you feel unsure, you should know that you can easily trade with a few kroner, and with a very small risk. In this way, you can trade with modest amounts until one day you feel confident and understand it all. The article is written concerning the trading platform MT4 linked together with an account with the trading platform Markets.

| Try our free forex signal service via Messenger: Click here |

Forex Trading

Currency trading is the largest financial market on the globe. It is estimated that over 7.000 billion USD worth of currency pairs is traded daily. This is far more than all the stock markets in the world combined. In other words, it is a colossal market with an incredibly high volume. The high volume naturally makes it extra interesting for traders to speculate in different currencies.

Most private investors deal solely with stock trading and buy and sell shares when they trade on the stock exchange. This typically means that as an investor, for example, you buy Novo Nordisk stock if you expect that the price of Novo Nordisk is about to rise. Conversely, you typically sell the stock again if you fear that the price will fall.

In broad terms, this is also how it works when trading currencies. However, here you do not buy and sell shares. Instead, you buy and sell the value of two currencies against each other, i.e., you trade money for money instead of stocks. Often, trading is also done with built-in leverage, for example via CFDs, where you only need to deposit a small amount of what you are trading for (your exposure). This very important part is explained in more detail below.

Currency pairs

The instrument EURUSD is also called a currency pair, and when you buy it, you are betting (just like when you buy Novo Nordisk shares) that the EUR will increase in value against the USD. If, on the other hand, you believe that EUR will decrease in value against the USD, you should instead sell the currency pair (i.e., short it).

Most trading platforms offer many different currency pairs. Some of the most traded are:

- EURUSD

- EURGBP

- EURJPY

- USDCAD

- USDCHF

Currency trading always involves two currencies against each other, because you are trading the value of one currency against the value of the other. In this process, the focus is on currency trading in the form of currency pairs, which are traded as a financial instrument in the form of a Contract for Difference (CFD).

It is important to understand how trading with currency pairs works in practice. The currency listed first in a currency pair is called the base currency. The second currency is called the quote currency. For example, in the EURUSD pair, the base currency is EUR, and USD is the quote currency. The exchange rate thus describes how much of the quote currency is needed to buy one unit of the base currency. If EURUSD is traded at 1.20, it means that you need to pay 1.2 USD for 1 EUR. For instance, if you buy 1000 units (i.e., 1000 euros) of EURUSD at a rate of 1.20, it means that you need to pay 1200 USD for the 1000 EUR.

| Try our free forex signal service via Messenger: Click here |

Currency can be traded almost around the clock, five days a week, from Sunday evening to Friday evening. In this way, currency trading is a particularly interesting alternative to regular stock trading, as it offers several exciting advantages and opportunities on most trading platforms:

- The opportunity for trading around the clock on all weekdays.

- A market with extremely high liquidity (amount of money).

- Potential for high volatility (movement), which provides trading opportunities.

- Tools to manage risk and exposure.

- The ability to profit in both rising and falling markets.

- The opportunity to hedge against currency risk (hedging).

- The possibility of leveraging with relatively low margin requirements (this is elaborated below).

Essentially, individual currency rates move relative to each other based on very complicated factors involving the economic conditions in each country but are also heavily influenced by political circumstances. Currency trading is a prerequisite for almost all international trade. For example, if a Norwegian company wants to buy goods from an American supplier, the Norwegian company often has to pay the supplier in dollars. This creates a need to exchange one currency for another. In this way, trillions of dollars are traded every day.

As a private investor, it is generally quite easy to start trading currency pairs through a trading platform, and it is not necessarily required to understand or delve into all the economic and political conditions that occur. Instead, one can use various strategies, for example, technical analysis of price patterns or supply and demand.

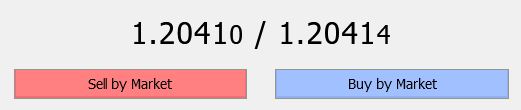

When you open your trading platform, such as MT4, linked with an account at the trading platform Markets, and navigate to the currency pairs (forex), you will typically see a long list of currency pairs available for trading. The current rate for each currency pair is indicated with Bid and Ask, as shown in the table above. The difference between the two is called the spread and constitutes the trading costs.

For example, under Ask, it might be listed as 1.26796 for the USDCAD pair (i.e., US dollars against Canadian dollars). This figure shows your buying rate and means that it costs 1.26796 Canadian dollars to buy 1 US dollar. If the price rises to, for example, 1.3332, it now costs 1.3332 Canadian dollars to buy 1 US dollar. In other words, in this case, the US dollar has now increased in value relative to the Canadian dollar, because it now takes more Canadian dollars to buy a single US dollar.

Important terms in Forex trading

In the following, we will explain different important terms which are essential in the forex markets.

Pips

When discussing changes in exchange rates in the currency trading market, the term “pip” is used, which is an abbreviation for Price Interest Point. It represents the smallest unit that can be measured in a currency exchange rate. It typically refers to the last decimal place in the exchange rate. Often, this is the fourth decimal place. This is because currency pairs very rarely move more than a few decimal points. If the price of a currency pair increases from 1.3600 to 1.3605, it is said that the price has moved 5 pips, which is the difference between the two numbers measured in points (pips).

There is a significant exception regarding which decimal is measured when the Japanese yen is involved in a currency pair, such as USDJPY. In these cases, the number of pips is measured on the second decimal place. If USDJPY trades at, for example, 107.25 and 107.26, the difference of 0.01 represents 1 pip.

The word “pip” may sound a bit peculiar, but it is simply the difference between two exchange values in a currency pair, corresponding to a measurable number of points.

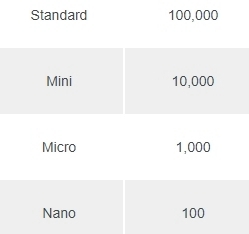

Lots

The term “lot” refers to the portion size of currency that you can buy from a broker. A so-called “standard lot” corresponds to a portion of 100,000 units of currency. For example, let’s say you buy a “standard lot” of the currency pair AUDUSD (Australian dollars against US dollars). Let’s assume in this case that the exchange rate for AUDUSD is at 1.2000. This means that you need to pay 1.2 USD to buy 1 Australian dollar. If you buy a “standard lot,” it means that you are buying 100,000 Australian dollars (100,000 units of the base currency). To purchase them, you will need 120,000 USD.

It is quite a lot of money, but fortunately, most brokers offer the option to trade in smaller portion sizes. Additionally, most trading platforms also operate with leverage, which means that you only need to provide collateral for a certain percentage of the 120,000 USD to buy a position of this size. We will return to this topic later.

If you use the trading platform Markets in conjunction with MT4, you can trade currency pairs in what is called “micro lots,” which correspond to just 1000 units of the base currency. For example, if you are trading AUDUSD, it’s 1000 AUD, and if it’s EURUSD, it’s 1000 EUR.

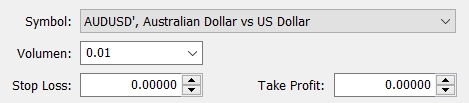

For beginners, it’s a really good idea to start with micro lots, as this minimizes the risk in each trade. If you want to trade in micro lots on the MT4 platform, you should enter 0.01 in the trading window under volume. Refer to the screenshot below for guidance. In the next lesson, we will return in detail to how you use the trading window and execute a specific trade.

A standard lot is valued at 1, and a micro lot is one-hundredth of a standard lot, which is 0.01. In terms of basic units of currencies, this corresponds to 100,000 and 1,000 units respectively.

In the above example with AUDUSD, you can choose to buy just 1,000 Australian dollars, which means you would need to pay 1,200 US dollars. Although a certain amount of dollars is required for the purchase, it’s worth remembering that the money isn’t simply gone. It has just been exchanged into Australian dollars, which can be immediately sold again if desired.

The actual trading of currency pairs is quite straightforward on the various trading platforms, where you can buy and sell different currency pairs in a split second.

| Try our free forex signal service via Messenger: Click here |

When trading currency pairs on MT4 in combination with Markets, you are also making use of a certain level of leverage, which is fixed. In simple terms, fixed leverage means that you don’t need to have the entire amount that you are trading with in your account. You only need to deposit a certain percentage of the value of the amount you are trading (your exposure).

What is at stake per pip?

While 1 lot corresponds to 100,000 units of the base currency, a micro lot of 0.01 equates to 1,000 units. In terms of EURUSD, this means trading with either 100,000 EUR or 1,000 EUR. This can be converted to what one “has at stake” per pip, which is expressed in the quote currency. So, in the case of the EURUSD pair, it’s in dollars. The following table shows that if you are exposed to 1 lot or 100,000 base units, each pip is worth 10 USD. If it’s 1,000 base units, it’s 0.1 USD per pip.

| Lots | Units | Value of 1 pip |

| 0,01 | 1.000 | 0,1 USD |

| 0,1 | 10.000 | 1 USD |

| 1 | 100.000 | 10 USD |

That means, if you have bought a micro lot of 1,000 base units in the EURUSD currency pair and the exchange rate moves from 1.2000 to 1.2010, then you have earned 10 pips at 0.1 USD each, totaling 1 USD in profit.

Gearing

When trading currency pairs in the form of financial instruments (CFDs), there is typically a fixed leverage built in, which is important to fully understand at a fundamental level. Leverage allows you to enter trades of a certain size with less money. This means that you can control a large position with a relatively small amount of capital, amplifying both potential gains and potential losses.

You’re likely already familiar with the concept of leverage from the housing market. For example, if a property costs 2 million kroner, instead of paying the entire purchase sum, you can typically just pay a certain percentage, say 10%, amounting to 200,000 kroner. The rest is borrowed from a bank or a mortgage institution. Translated to trading currency pairs, this is akin to the broker lending you money so you can leverage your trade. The broker can do this because you provide a certain security (margin) for the amount you wish to trade with.

Let’s say you want to buy 1,000 units in the EURUSD currency pair, corresponding to a so-called “micro lot,” which is the smallest allowable portion size you can trade through Markets. Let’s assume the exchange rate for this pair is at 1.20. This means that you need to pay 1,200 USD to buy 1,000 EUR.

The trade value (exposure) of this transaction is therefore 1,200 USD. The built-in leverage for buying this currency pair is fixed at 30:1, which means you leverage your money by a factor of 30. This implies that you only need to provide a margin of 1,200 / 30 = 40 USD (where 30 is the level of leverage). However, the value of the trade is still 1,200 USD, so you are effectively borrowing (1,200 – 40) = 1,160 USD from the broker. In other words, in principle, you only need to have 40 USD in your account if you want to expose yourself in the mentioned currency pair for 1,200 USD. In reality, however, you need to have more in your account, as there needs to be room for fluctuations in the exchange value of the traded currency pair, otherwise, you risk being limited in your trading freedom.

Let us explain it further:

Markets offers a fixed leverage of 30:1 for trading the major currencies, which include USD, EUR, GBP, JPY, CHF, and CAD. Minor currencies, such as DKK, NOK, SEK, etc., can be traded with a fixed leverage of 20:1. This built-in leverage thus allows you to trade a larger position, which is 20-30 times larger than what you would otherwise be able to. This allows for greater exposure than the actual amount of money you have.

To enable you to leverage your positions, the broker requires a security deposit, typically referred to as a margin. Using the house purchase analogy again, your margin is akin to your down payment. It’s the amount you need to have in your account to be able to borrow the rest of the money. In the above example, your margin was about 40 USD. In practice, what happens is that the broker reserves this amount from your cash account.

If you have an account with 1,000 USD deposited, and you open a position of 0.01 micro lots in EURUSD, equivalent to 1,000 EUR or 1,200 USD, the broker (in this case, Markets) will reserve 40 USD as margin. Subsequently, you will have 960 USD remaining in your account as a “free margin”. All these amounts are continuously reported via MT4. This also means that you now – in principle – have 960 USD left, which you can use as a margin for other trades.

Here, one should be cautious not to get too close to using too much of their account balance to open leveraged positions. By doing so, you take on both a significant overall exposure and run the risk of being unable to withstand potential declines in the market value of open positions because the trading platform reserves some funds in your account for each open trade.

When working with leveraged positions, it is essential to understand how much you can lose. If you do not feel confident in calculating the risk of a position, you should seek advice before taking your first trades. As a supplement or alternative to this, you can practice on a demo account to become familiar with the concepts and risks.

You can also start by trading with very small amounts in the beginning. This way, you get a sense of how much you are risking.

Margin Call

In terms of risk management, one of the most important metrics to keep track of at all times is the margin level, which is calculated continuously based on your account.

If you have used up all of what is equivalent to your entire account value in margin, i.e., 1000 dollars in margin, your margin level is now 100%. You have reached the point where most trading platforms, including the trading platform Markets, will close the possibility of opening further positions. Ideally, you would want to be well above this threshold of 100%.

If you’re interested in how the margin level is calculated, you can check out this article.

If your margin level falls even lower, for example, to 70%, you will receive a message from the broker indicating that you are in the danger zone. If your margin level drops to 50%, you will be subjected to a so-called margin call, where your trades will be automatically closed. According to regulations, the broker is obligated to forcibly close some or all of your positions until your margin level increases above 50%. This forced closure will happen automatically, and it’s a situation that you should make every effort to avoid. The easiest way to do this is by trading small positions (such as micro-lots) relative to your account size. This way, you can keep your level well above 100%, which is the optimal target. In other words, it’s about not overextending your risk relative to your account balance.

It may sound harsh that the broker will close your position during a margin call, but you should view it as a safeguard to prevent you from losing too much money. Furthermore, as mentioned, it’s a legal requirement for all EU-approved brokers, precisely introduced to protect private investors.

Spread

A spread refers to the cost, similar to commission, directly associated with the trade. The spread is the difference between the buying and selling price, representing the trading fees that the broker charges to allow you to open a position. Let’s say the broker offers the EURUSD pair with a bid-ask spread of 1.2300 and 1.2301. You can open a position at 1.2301 and potentially sell it at 1.2300 if the price doesn’t move. The difference of 1 pip constitutes the spread, which is your trading cost.

Swaps

When trading forex based on margin, it’s important to be aware that if you keep your position open overnight, you may incur a financing cost, also known as a swap rate or rollover fee. This is only significant if you’re trading with large amounts and/or holding positions for extended periods.

Videos for inspiration

If you want to learn even more, we recommend this video playlist, where key concepts are explained, and you can refresh your knowledge from time to time. We particularly recommend lessons 7 and 10. Another helpful video that demonstrates how to calculate your risk and determine the correct lot size can be found here:

Understand how to read a currency chart

If you’ve only tried investing and looking at stock prices in the traditional way, you’re probably familiar with line charts. A line chart reflects price movements with a simple line, typically based on periodic closing prices.

For example, take a look at the classic line chart below:

However, most traders do not use line charts but opt for a much more informative chart type known as a candlestick chart. Candlestick charts provide a wealth of information about price movements and are widely used in trading.

Candlestick chart

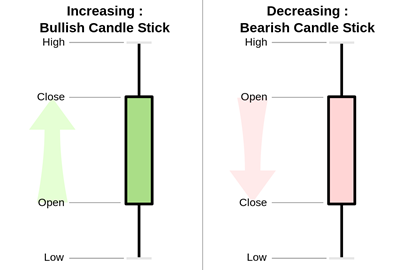

A typical line chart only displays the closing price, whereas a candlestick chart provides an opening price, the lowest price, the highest price, and a closing price for the selected time frame.

Therefore, a candlestick chart contains much more information than a simple line chart and offers a visually nuanced representation of how prices have evolved within individual time periods. It may take some time to get used to candlestick charts, but once you’ve done so, you’ll have a much better understanding of how prices have moved.

Each candlestick typically consists of a thick bar and two thin vertical lines, which represent the price range that the price has moved within a specific time interval, as shown in the chart above for a 10-minute interval. The thick bar in the candle (referred to as the body, and sometimes the thin line is entirely contained within the body) is typically depicted in colors such as green and red (often also shown as white and black).

This bar illustrates the difference between the opening and closing prices. If the bar is green, the closing price was higher than the opening price, indicating an upward direction in the market. If the bar is red, the closing price was lower than the opening price, indicating a downward direction in the market.

The image above shows two examples of how candlestick bars can appear. On the left, there is a green bar, indicating that the closing price (Close) was higher than the opening price (Open) during the given period. On the right, there is a red bar, indicating that the closing price was lower than the opening price. The two tails (also known as shadows) in the upward and downward directions signify that the price during this period – for example, 10 minutes on a 10-minute chart – has been both higher and lower than the opening and closing prices. Together, they represent the price range that the candle has moved within. The colored section that surrounds the closing and opening prices is called the body.

Bullish and bearish candles

A green candle is called a bullish candle because the price is rising, while a red candle is called a bearish candle because the price is falling. The longer the body of a candle, the more the price has moved during the period. The length of the body indicates the intensity of buying or selling pressure during a time period. Conversely, if the body is short, it indicates a small price movement, suggesting that the market has consolidated or is indecisive.

On most trading platforms, you can customize the colors to suit your preferences, such as using white for bullish candles and yellow for bearish candles. The principles remain the same regardless of color choices.

Both day traders and longer-term traders use a variety of candlestick types and formations to interpret price movements. For example, if you see one or more long red candles on the chart, it indicates that the market is moving rapidly downward, and it can be very risky to buy before the market has consolidated a bit and indicated that it might be ready for a reversal. This situation is often described as trying to catch a falling knife, and it’s a strong warning. Trying to buy in a market that is moving rapidly downward can be very dangerous. In such cases, it’s better, or at least safer, to wait and see if the market stops, perhaps by forming a doji, as explained below. However, there’s no guarantee that it will actually happen.

Special candlesticks

An example of a specific candlestick type is a doji candle, which is a candle that has tails or wicks on both ends but a very small, or no, body because the opening and closing prices are at the same level. It most resembles a cross. An example of a doji can be seen below. Traders view a doji as a sign that the market may be on the verge of a reversal or as a sign of indecision.

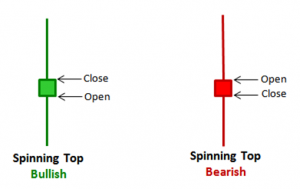

Another example is the so-called Spinning Top candlestick, which has a small body with long wicks or tails in both directions, as shown below. Like dojis, this type of candlestick signals indecision in the market.

How to Make a Currency Trade

Let’s look at an example where we want to buy the EURUSD currency pair, which means we are buying euros against dollars, expecting the euro to rise against the dollar. Based on the chart below, we have analyzed that we want to buy at the rate of 1,0837, as there appears to be an interesting support level at this price.

We now need to specify how much we want to trade (our exposure), and as mentioned earlier, the term “lot” is used to describe the volume you want to trade. The volume size determines how much you are essentially putting at risk per pip (movement in the price chart). Above, we described what a “pip” is – usually the fourth decimal place in the exchange rate (and in rarer cases, the fifth decimal place) for a currency pair.

| Try our free forex signal service via Messenger: Click here |

In this example, if we buy at a rate of 1,09045 and sell at 1.09035, we have lost one pip because the fourth decimal place has moved by one position. In this case, you can choose to ignore the fifth decimal as it is 0, and it represents only a fraction of a pip.

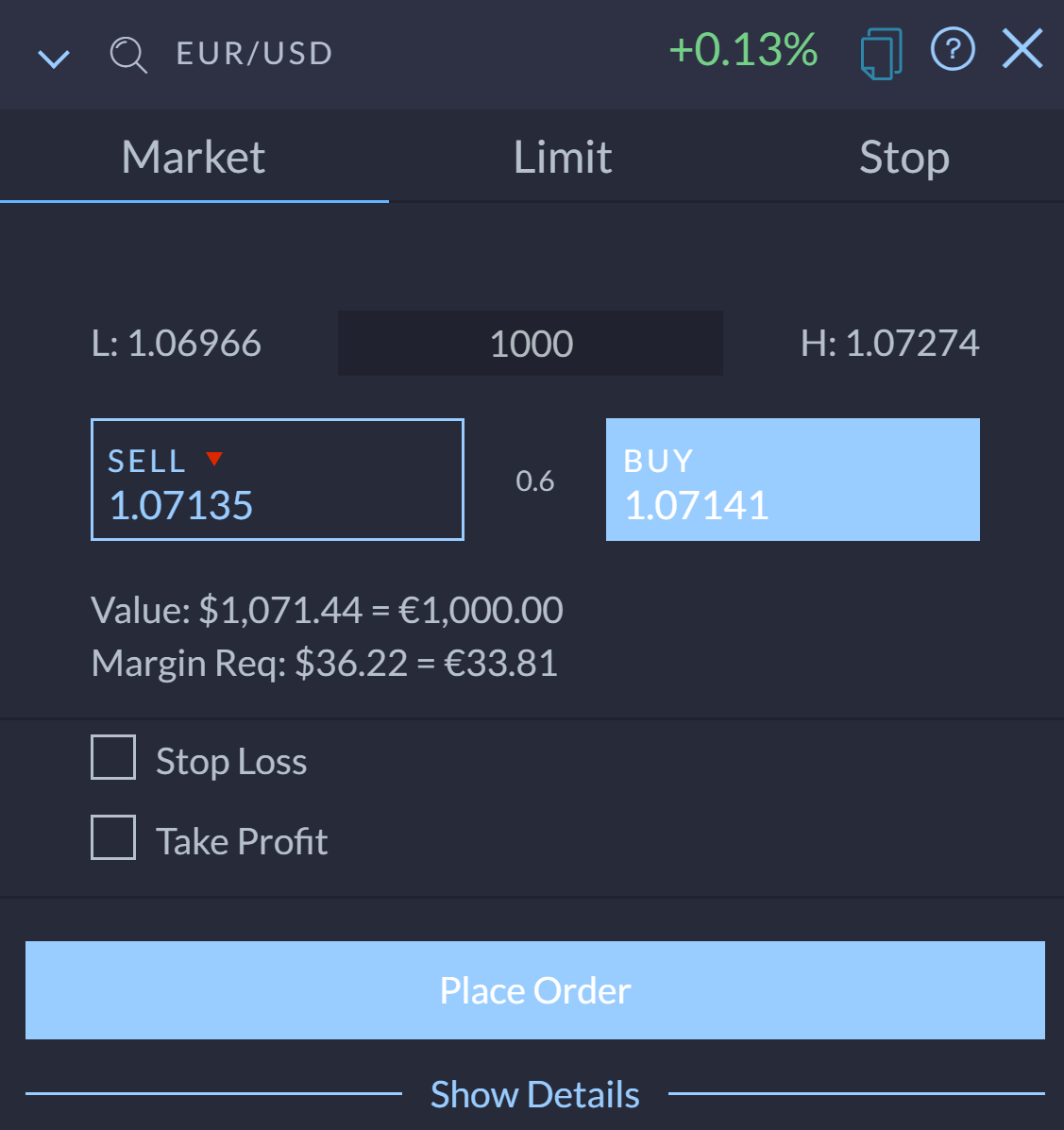

When you want to make a trade, you press buy or sell in the upper part of the chart in Markets. A trading window will pop up, where you can specify your trade:

In the order window, you can specify the details of your trade. From her, you can set Take Profit and Stop Loss orders. Under “Show Details” you can see more technical information about the instrument.

You can specify how much you want to trade in the top window. Here, you can choose to trade as low as 0,01 lots (1.000 base units) and up to 30 lot (3.000.000 base units) or even higher if needed. If you want to trade a micro-lot (1.000 base units), you would enter “1000”, while “10000” indicates that you want to trade a mini-lot of 10.000 base units, and a value of 100.000 represents a standard lot.

If you trade, for example, a mini-lot (0,1 lot) in the EURUSD pair, it means you are exposed to 10.000 EUR or 10.714 USD if you buy at a rate of 1,0714. This might sound like a significant amount, but it’s important to note that there are many days when a currency pair doesn’t fluctuate more than 0,5-1%, which would result in a potential loss or gain of approximately 60-120 USD. On days when the market moves more, your potential losses or gains could be higher.

Furthermore, one must remember that trading on margin, and with the built-in leverage of 1:29 in EURUSD, your capital requirement (margin requirement) is only 1/29th of the position, which in this case would be around 365 USD. When trading a mini-lot (setting the volume to 0.1), you risk 1 USD per pip in a currency pair with USD as the quote currency, such as EURUSD.

If you find this level of risk to be too high, you can choose to trade micro lots, where you are exposed to 1.000 USD and 0,1 USD per pip. You do this by setting the volume to 0.01, and in this setup, you could lose approximately 10 USD if the market moves 1% in the wrong direction. The value of a pip in this case is 1.000 * 0,0001 = 0,1 USD. The margin requirement to open a trade in a micro lot is approximately 40 USD.

When setting the stop-loss level, you can either set it at a certain price, amount of pips, or for a possible loss level.

It should be noted that a stop-loss is not always triggered. In the event of an extreme situation in the currency market, it is possible that it may not be activated because the market jumps from one level to another without allowing you to close your position. However, in this case, you are risking such small amounts that even in an extreme situation, you would not end up with a significant loss.

On the chart below, you can see what it looks like when you have placed a trade. The Blue line indicates your opening price, i.e. at the price you bought, the purple line is the take-profit level, the brown line is the stop-loss level, whilst the (in this case) red line is the current price. The red line turns green when the price is higher than the opening price. Above is a list of all your open positions, and you can change which chart you want to look at simply by clicking on a position if you have more than one.

If you’re unsure about how this works, you can start by trying it out with the smallest possible trading value to see how it goes. If you’ve just deposited money into your account, it’s a good idea to start small with a micro-lot and set the pip volume to 10, as shown in the screenshot above. You do this by entering 10 in the “Pip” option.

The easiest way to learn is by placing some fictitious orders and stop-losses and then moving the mouse over them to see how much you can lose if the stop-loss is triggered. So, try testing it with some different fictitious orders that are far from the current price level, and only move on when you are completely sure that you understand how much you are risking. It’s possible to trade with very small amounts in the beginning, and we recommend doing so until you feel confident about the risk involved.

Get started with Markets and MT4

This section covers how to open a trading account with the broker Markets and then download and connect the trading platform MT4. You can trade through Markets‘ own trading platform, but if you want to use some of the external tools developed for MT4, you’ll need to install it as well.

The first step is to open a trading account with Markets. After that, you should open an MT4 account through Markets’ website and download the MT4 trading platform. Once you’ve done that, you’ll be able to install indicators to use in MT4.

If you’re using a Mac, you can follow this guide.

MT4, also known as MetaTrader 4, is a free software that serves as a trading platform and charting tool. However, it functions only when you import trading data into the system. You’ll receive this trading data when you open an account with Markets.

Open an account with Markets

We recommend Markets when trading forex pairs or other financial instruments. This broker is licensed and regulated to operate in the EU and several other countries. If you’d like to learn more about Markets, you can read our comprehensive review and description of Markets here.

You can sign up with Markets here. You can choose between a few different base currencies, however the most common are either USD or EURO. You will now be asked to fill out a series of fields related to yourself and your knowledge of CFD/forex trading. This takes about 5 minutes. The personal questions relate to residence, income, etc. These are the exact same types of questions you would be asked when opening a bank account with a regular bank. These questions are simply a legal requirement, and you must answer them as accurately as possible. You will also need to submit documentation to verify your identity and address.

Connect your Markets account with MT4

As mentioned earlier, Markets already has its own trading platform where you can trade forex and other CFDs. However, if you want to use externally developed software, you need to use the MT4 trading platform. To download MT4, go to your new Markets account and find the “My Accounts” menu option at the top right when you are logged in to Markets on a desktop computer. Here, you can download MT4.

If you’re using a Mac, you can follow this guide.

MT4 is now connected to Markets, and all the price data you see in MT4 is sourced from Markets. When you make trades in MT4, they are executed through Markets. You can still trade directly through Markets if you prefer, but if you want to use special indicators directly on the price chart, it can only be done through MT4.

Minimize costs

Markets is compensated for its services through the Buy/Sell (Bid/Ask) spread (click here to learn more about this), so when you open a position, you essentially “pay” the spread. This spread is incorporated into the Markets quoted rates and is not an additional charge or fee payable by you above the quoted rates.

When trading currency pairs, it might be smart to open accounts in different currencies to minimize conversion fees. Markets will charge a Currency Conversion Fee for all trades on instruments denominated in a currency different from the currency of your account. The fee is charged as follows: Exchange rate received from liquidity providers plus a markup.

Q&A

What is a currency pair?

A currency is always traded relative to another currency. For example, EUR/USD is a currency pair where you trade EUR against USD. You buy the pair if you believe that the euro will rise in value against the dollar, and you sell it if you believe that the euro will fall in value against the dollar.

What is a pip?

Price interest point (pip) is the smallest unit that can be measured when the exchange rate of a currency pair changes. It typically refers to the fourth decimal place in the exchange rate of a currency pair.

What is a lot?

A lot is the term used to describe the volume traded, for example, in MT4. 1 lot is equivalent to 100,000 base units. The smallest lot size one can typically trade is a micro lot of 0.01 lot, which is equivalent to 1,000 base units.

Do I have to pay tax on currency trading?

Yes, for individuals, currency trading is taxed as a financial contract, and it is subject to capital gains tax under the principle of accrual.

What is MT4?

MT4 is an independent trading platform that can be used once you have an account with a broker.

Which broker can I trade currency pairs with?

Markets offers trading in currency pairs in the form of CFD contracts with attractive spreads and offers trading via MT4.