Markets is an EU-based broker that, since 2008, has offered CFD trading on a global scale via a user-friendly trading platform in virtually all types of assets at competitive prices. It is also possible to trade via MT4 and MT5.

You should choose Markets.com for the following reasons:

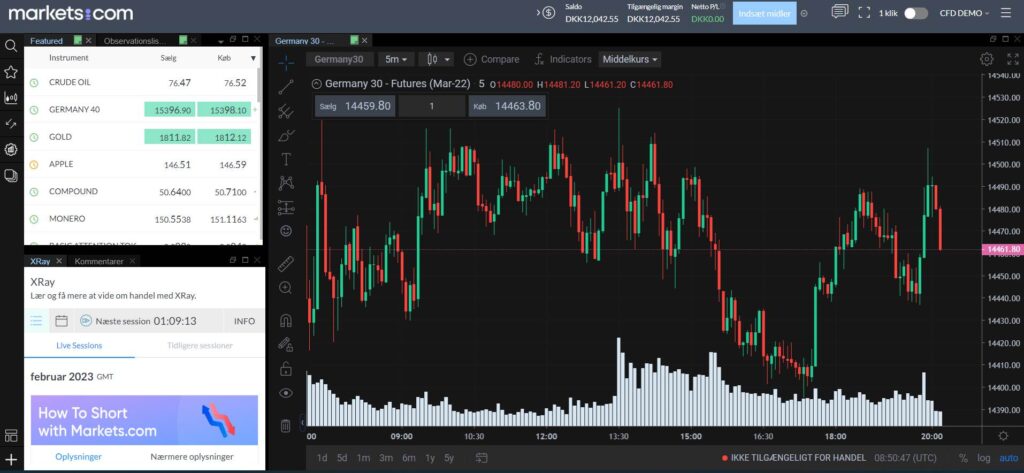

- User-friendly trading platform in English, Swedish, Danish, and more, making it easy for beginners to get started.

- Comprehensive chart module for analysis.

- Lots of free trading tools, for example, information on insider and hedge fund transactions.

- Access to XRay – Markets’ video news service, which can be watched live every day of the week.

- Access to a free demo account to familiarize yourself with the platform and test strategies.

- A large product range with competitive prices.

- The ability to leverage and go short in the market via CFD products.

- Easy switching between different account types with the same user login.

- Account in NOK, SEK, DKK, EUR, USD, etc. – it’s recommended to initially open an account in your regular currency (and possibly other currencies later) to save unnecessary exchange costs.

- Low requirement for the first minimum deposit (100 USD)

- Retail investors are covered by the EU’s investor protection rules, for example, with negative balance protection.

Sign up for Markets here or read the detailed review below.

You can also download our guide on how to start trading and how to register as a customer with Markets here.

If you are new to active trading, we recommend that you participate in one or more of the free online courses that we offer. Participation in these courses, which, among other things, equip you well for active trading, is free, but as a customer of Markets, you get access to even more material.

Markets was established in 2008 and is offered today worldwide in a variety of different languages, including both Swedish and Danish. At Markets, one can both go long and short in the market by trading a wide range of CFD products, which typically have fixed leverage. Additionally, it is possible to open both MT4 and MT5 accounts.

Trading is done either via the easily accessible web-based trading platform or via a mobile version in, for example, Danish kroner or in foreign currency.

Markets.com is the brand name for the trading platforms that are formally operated by the broker Safecap Investments Ltd (Safecap), which is based in Cyprus. Therefore, the broker is approved to provide investment services by the Cypriot regulatory authority, the Cyprus Securities and Exchange Commission (CySEC), for clients from, for example, the Nordic countries.

The ultimate owner of the trading platform Markets is the Asian private equity fund Gopher Investments.

Like many of its competing foreign platforms, Markets.com is subject to Cypriot supervision and legislation. This means that as an investor, you are covered by the EU-based financial legislation that applies throughout the EU, including the important minimum protection rules that apply to retail investors. The broker has also been registered since 2009 with the Danish Financial Supervisory Authority with regard to offering investment services in the Nordics under MiFID rules’ “passporting arrangement”.

What kind of traders is Markets suited for?

Since it is possible to place low minimum exposures per trade in most instruments, one does not necessarily need a large deposit capital (the minimum requirement is 100 USD, equivalent to about 700 DKK). This makes the trading platform quite suitable for traders who want to get acquainted with leveraged products in the form of CFD trading. The account can be opened in DKK and other currencies. Both on Markets.com’s website and on the web platform, it is possible to change languages. This distinguishes it from many of the other foreign providers on the market, although more and more are beginning to translate platforms and websites into different languages. However, the news feed and certain documents such as the Investment Services Agreement (terms of business) are not translated.

As an EU broker, Safecap offers negative balance protection, which means that as a retail customer, you cannot risk losing more than your account balance. This is quite reassuring, especially for a newly started trader.

You have the option to open an unlimited free demo account, where you can test Markets’ web platform and the associated mobile platform. As you explore your account, it’s also possible to get explanations of many different features, and in many places, you can easily click on the chat function and quickly start chatting with a Markets employee, which typically occurs in English. However, there are also Danish-speaking staff employed who can assist with customer creation and later on.

How to open an account with Markets

After registering your account with your name and email, you have to verify your account to start trading. Watch the following video to see how:

Design and platforms

Markets.com offers trading with CFDs via a web-based trading platform and a mobile app for both iPhone iOS and Android. When you log in through Markets.com’s website, you get access to your accounts, such as CFD trading in different currencies or MT4 and MT5 accounts, through the entrance portal My Portal. It is also in My Portal where you gain access to your demo account and can pull up account statements, as well as transfer funds in and out of Markets and exchange internally between your accounts (without an addition to the exchange rate).

Web Based Markets

When you log in to the web-based platform, a graph for a given instrument is displayed on the right side, along with a customizable course list, news, etc., on the left side. If you have chosen Danish as the language, be aware that not all words and concepts have been translated equally effectively. For example, the term ‘Free margin’ has been translated to ‘Gratis margin’ (the term covers how much money you have available for margin trading). Fortunately, you can switch the language at any time, for example, to the main language, English, if you want to avoid any misunderstandings.

You can choose between an advanced and a simple layout, which can be done under Settings at the top right of the platform. If you choose the advanced version, you get direct access to a wealth of trading information, news, ongoing display of current spreads, etc., which is clearly recommended.

The platform is well-structured and easy to navigate. You can choose between a black and white background. While it’s not possible to make many changes to the relatively fixed setup, you can enlarge or reduce the graph view and the menus on the left side, which show selected product types, upcoming events, and news. If desired, on the far right side of the screen, under the icon that shows some bars, you can select Settings and Platform Features to choose the simple approach instead. This is also where you change the background color and other settings. In many places on the platform, you can also click on a question mark to quickly get explanations of individual elements if you’re unsure about anything.

At the top right, key account details are also displayed, such as balance, open net profit/loss, used margin, etc. You can customize which specific details you wish to see. Here, you lack the option to see a consolidated figure for your exposure, but this is unfortunately not uncommon for many trading platforms.

At the top left, there is an efficient search function where you can quickly search for already-known instruments. If you want to closely follow a specific instrument, you can mark the little star that appears next to the name, and the instrument will be added to your personal watchlist, located just below. The instruments you click on, for example, in the watchlist, are automatically displayed on the graph on the right side of the screen.

Further down on the left side of the screen, there are buttons for your open positions and orders. Even further down, you can click on the different types of assets, such as stock indices, currency crosses, commodities, individual stocks, and so on.

When you click on a specific instrument, it is immediately displayed in the graph on the screen. Just above the graph, you will find buy and sell buttons, which you can click on to open a trading window. This is explained in more detail below.

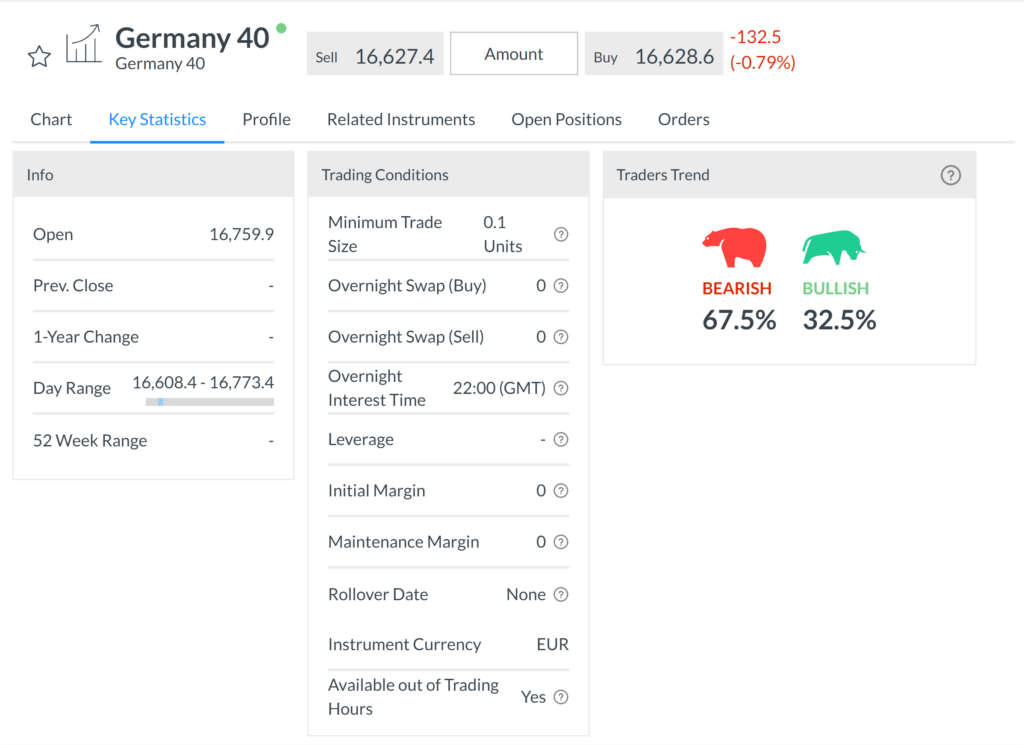

For each instrument, there are several information pages. The first – and probably the most important – is the graph module (chart), which is immediately displayed. This is followed by key statistics with data on the instrument, for example, margin requirements, upcoming events, open positions, orders, etc.

Graph Display

The graph display on the Markets platform functions very well, with smooth rendering of the price chart and other price information. The instrument displayed is always the one you most recently clicked on in the instrument list on the left side of the screen. The graph also shows any open positions, indicating current profit/loss. This latter feature is particularly good and very useful. By clicking the small cross next to an open position, you can quickly close the position either entirely or partially. Alternatively, clicking on the field that shows the current profit/loss allows you to edit levels for stop loss and take profit.

It’s possible to display the price chart with candlesticks, view price data up to 5 years back, see volume (i.e., the volume contributed by Markets’ customers) for each instrument, and insert a range of technical indicators (over 70 different types) on the given instrument. It is also possible to draw support lines, trend channels, apply Fibonacci retracements, etc., which are carried over to the individual instruments you choose to display.

You can display up to 8 charts at a time on the same screen if you select the “Multiple Charts” menu at the top of the screen, which is the icon showing some windows. However, this requires a screen of a certain size to be meaningful. It is not possible to drag the chart out of the screen view if, for example, you have multiple screens set up. If you want to display charts on multiple screens, you need to open several instances of the web trader in different browsers. This works fine, and you can thus have plenty of open charts.

Alarms

It’s also possible to set various price alerts by clicking on the icon with the 9 dots at the top right of Markets’ web trader, which symbolizes the Trading Tools Menu. The alerts can be configured for individual assets at specific price levels, percentage daily price movements, changes in recommendations, etc. You can set up as many alerts as you wish and receive them via email or through push notifications directly to the mobile app or in the web trader.

Trading is done most quickly by clicking buy or sell on the individual instruments in the price lists at the top left of the screen. This action opens a trading window, as shown in the accompanying image. If you click on the small arrow at the top left of the trading window, the trading terms for the instrument are displayed. Here you can find a number of additional useful information such as minimum trading volume, margin requirements, overnight interest levels, possible roll-over dates, etc.

Markets operates with three types of orders/trades, which are named Market, Limit, and Stop.

When choosing the Market order type, you place an order to trade immediately at the current market level. Simultaneously with the order placement, it is possible to specify stop loss and take profit price levels. For each price level, the approximate net result is calculated, converted to your denomination currency. This is a quite elegant feature.

In connection with the order placement, the total exposure you are undertaking (referred to as Value) is displayed, as well as the margin requirement you are committing to, converted into your denomination currency, for example, Danish kroner, which provides a really good overview.

When you choose the Limit order type, you can place a pending order at a predetermined price level that is better than the current market price. This means a lower level if you wish to buy (go long) and a higher level if you wish to sell (go short).

Choosing the Stop order type allows you to place a pending order at a price level that is “worse” than the current market price. This means a higher price level if you wish to buy (i.e., go long) at a higher price than the market price, or a lower price level if you wish to sell (i.e., open a short position) at a lower price than the market price. For instance, an Entry Stop buy order can be used if you want to see a certain increase in the market before choosing to buy yourself.

The placed orders, as long as they are active, can be seen by clicking on the Orders module on the left side of the screen. When you have clicked on the module, you can quickly press X to cancel a given order or adjust the limit price, etc. The unexecuted orders can also be seen on the chart for the individual instrument.

The order placement process as a whole works well and is very informative. You can quickly close open positions or modify existing ones, which is, of course, crucial if the market suddenly becomes volatile.

Mobile App

It is possible to download a mobile app for both Android and iPhone. This app is particularly useful when you’re on the go. It is a simple and user-friendly app that offers the basic necessary functions. In addition to being able to trade, you also have access to price information, simple chart viewing, price alerts, support, and portfolio functions. It is also possible to transfer and withdraw funds and view your account history. You can access all your different accounts and demo accounts.

Markets and products

the trading platform Markets offers CFD trading in over 2000 different products divided into stock indices, commodities, ETFs (i.e., passive index funds), individual stocks, currency crosses, cryptocurrencies, and a few bonds.

It’s important to note that trading with CFDs involves leveraged transactions, which means that to trade a given exposure, you only need to provide a specified margin, i.e., collateral, depending on the asset you want to trade. The size of this margin and therefore the leverage factor depends on which product (asset type) you trade. For example, the American Dow Jones index can be leveraged 20 times, while individual stocks can typically be leveraged 5 times. Trading with CFDs, precisely because of the leverage element, is not necessarily suitable for everyone, so it is strongly recommended that you thoroughly understand how these types of products work.

You can find Markets’ products, minimum spreads, gearing factors and more here.

Indices

It is possible to trade both larger and smaller indices from over 20 countries. The margin requirement is 5% for major indices, such as the three major American indices and the German DAX, corresponding to a leverage of 20 times, while for smaller indices, it is 10%, corresponding to a leverage of 10 times.

When trading indices, you typically need to trade a minimum of 1 lot/1 contract at a time. However, it is possible to trade fractions down to 0.1 contract for several of the larger stock indices, such as Dow Jones (referred to as US30), S&P 500 (US500), Nasdaq 100 (US Tech100), DAX (Germany 40), and FTSE 100 (UK100). When it comes to stock indices, 1 contract will represent the value of the index, i.e., its face value. This means for DAX traded via the CFD ‘Germany 40’ at a rate of about 12.600, the exposure for 0,1 would be about 12.600 EUR, i.e., 1.260 EUR, while S&P 500 (referred to as USA500) can be traded with an exposure of about 0,1 * 3.300 USD, i.e., 330 USD. You can typically trade the major indices almost 24 hours a day on weekdays, except for about an hour around 23:00, when contracts are settled.

If you generally want to trade with a smaller stake, i.e., with the lowest possible exposure, you should either trade indices that are traded at low face values or trade a fraction of the index if this is possible. For example, if you were to trade 1 DAX contract, its current value is approximately 94.000 DKK, thus requiring a margin of about 4.700 DKK with a 5% margin requirement. But the DAX can be traded in fractions of 0.1, which means that you can limit your exposure to about 9.400 DKK or approximately 470 DKK in margin.

In addition to the margin requirement, you must also ensure that the balance in your account can accommodate the subsequent price movements if the price moves in the opposite direction of what you anticipated (and at a minimum, the maintenance margin required by the trading platform to avoid the risk of forced closure of your position). Other low minimum stakes can be seen in the table above.

The current minimum spread for the DAX is indicated at 1.2, while the Dow Jones can be traded with a spread of 2.75.

Individual Stocks

If you wish to trade individual stocks based on CFDs, you can currently trade over 2000 selected stock CFDs on the Markets platform. This includes not only stocks from major international markets but also selected liquid Swedish and Norwegian stocks, as well as 22 Danish stocks. Furthermore, it is possible to trade a number of Chinese stocks listed on the Hong Kong Stock Exchange.

When trading stock CFDs, the typical margin requirement is 20%, which corresponds to a leverage of 5 times. There is no commission charged for the trade.

Calculated at a random point in time, Markets had a bid-ask price for this stock at 111,63 to 111,7, i.e., a spread of 0,07 USD, which constitutes about 0,06%. In comparison, the spread for trading directly on the American stock exchange at the same time was 0,01 – 0,02 USD, i.e., about 0,01% – 0,02%. Therefore, the spread at Markets.com is slightly larger than when trading directly on the exchange in the underlying stock. When trading, it’s important to remember the 5 times leverage, which means that you only need to provide 20% of the chosen exposure as margin.

Commodities

Trading in 23 different types of commodities is offered with a leverage of 10 times, except for gold, where it is possible to leverage 20 times. For example, it’s possible to trade US crude oil futures down to 10 contracts at a time, providing an exposure of about 400 USD with an associated margin requirement of 40 USD. The minimum spread for oil is indicated at 0,4 USD. Gold can be traded with a spread as low as 0,3 USD, where the minimum investment is 1 contract (i.e., 1 ounce) at about 1.900 USD with a 5% margin.

Currency Pairs

Regarding currency crosses, more than 50 different pairs are offered, including all the major currencies as well as several minor and so-called exotic currencies. As a general rule, it is possible to trade around the clock with few exceptions.

For EUR/USD, the minimum spread can be as low as 0,7 pips. The margin requirement for the major currency pairs is 3,33%, which corresponds to a leverage factor of 30. As for the minor currency pairs, the margin requirement is 5%, corresponding to a leverage factor of 20.

The smallest possible exposure is 1,000 base units, for example, 1,000 USD when trading the EUR/USD currency pair, making it possible to trade currency with low exposure. In the case of EUR/USD, this translates to an exposure of about 1.000 USD with an associated margin requirement of approximately 33 USD.

Crypto Currency

It is possible to trade various major cryptocurrencies with typical leverage of 2 times. All cryptocurrencies are traded as CFD contracts, so it is not necessary to possess a wallet. Therefore, you are not exposed to the risk of being hacked or losing your assets in other ways (apart from regular price fluctuations, of course).

Regarding Bitcoin, the margin requirement is 50%, and it’s possible to trade down to 0,01 Bitcoins at a time, which currently corresponds to an exposure of about 546 USD with an associated margin requirement of approximately 228 USD.

For other cryptocurrencies such as Ethereum, Dash, Cardano, Litecoin, Ripple, etc., the margin requirement is also 50%, meaning these are leveraged by a factor of 2. It is possible to trade down to 0,01 units of these, which for Ethereum means a minimum exposure of about 24 USD with an associated margin requirement of 12 USD.

If you hold your position overnight, you will be charged a relatively high financing cost for certain cryptocurrencies, which means it is not attractive to maintain your position over longer time horizons. It is possible to trade cryptocurrencies around the clock throughout the week, but not on weekends.

Blends

Markets has launched a series of theme-based CFD funds, the so-called blends, which means that it is possible to get exposure to a number of stocks within sectors such as Social Media, US Tech, E-commerce, Buffet, Cannabis, Trade War Winners, Trade War Losers, etc., by purchasing these funds.

It is possible to leverage each of the individual blends/funds 5 times, as they are traded in low nominal values, allowing for low minimum exposures if desired. Under each blend, you can see the specific stocks you are exposed to, their distribution, and how the blend has performed historically.

Trading Tools

Markets offers a wide range of trading tools for free, which can help you keep your finger on the pulse of the market and select exciting investment candidates.

The trading tools can be accessed at the top of the web trader by clicking on the icon with the 9 dots (highlighted in the accompanying image). Under the Fundamental section, you can find a detailed overview of upcoming significant economic indicators (referred to as Events), market commentary, and relevant market news including from Dow Jones Newswire.

Under the price alerts section, you can create new alerts, for example, on the price development of an asset, and view a consolidated overview of the alerts you have set up.

Under the heading “Sentiment,” you can find information such as insiders’ transactions in various stocks, which some investors consider a significant input for their investment decisions. You can also read various analysts’ trading recommendations and contributions from different finance bloggers. Additionally, you can see how certain hedge funds have positioned themselves in selected stocks and how they have recently bought or sold shares.

Finally, you have access to the extensive Knowledge Center, which includes Markets’ own news channel, Markets View, providing access to a wealth of live broadcasts about the market’s condition throughout most of the week. You’ll also find educational videos that explain the use of trading tools, volatility, etc. Furthermore, Markets supply their own video tutorials on how to use their platform, allowing you to take advantage of all their services early on.

If you have chosen the advanced layout view of the trading platform, on the left side of the screen, you will see various elements such as news, key figures, etc. You can choose exactly what you want to be displayed.

All in all, it must be said that Markets offers access to some quite versatile trading tools. Not all the tools will necessarily be beneficial, but the opportunity is there, and it is easy to navigate through the different tools.

Forced Closure of CFD-Based Positions

If the balance of one’s account falls below 50% of the required margin, the trading platform will automatically close one or more open positions to prevent the risk of further losses. Accumulated information about this can be found under the “Fund Management” section on the homepage of the trading platform’s web browser and in the mobile version. The reason for this is the so-called margin close out rule, which the European securities authorities, ESMA, have required to be introduced to protect retail investors from the risk of significant losses.

Prices

Market.com generally offers relatively low minimum spreads when trading CFD-based products. Previously, Markets charged a commission for trading stock CFDs, but fortunately, this is no longer the case.

If one keeps their CFD positions open for an extended period (i.e., “overnight”), financing costs are incurred, the size of which depends on the type of product and the currency in which the product is traded. Currency crosses, commodities, and stock indices typically have lower interest costs than, for example, stocks and cryptocurrencies. The specific interest costs for each instrument can be seen under the “Key Statistics” tab when logged into the trading platform. The interest rate provided here is per day, so it must be multiplied by 365 if one wishes to know the annual interest rate.

If you trade in a currency different from that of your account denomination, you will have to pay a currency exchange fee of 0.6% on, among other things, the result of each trade and the margin call. However, the exchange fee for individual trades can be avoided by opening a currency account in the currency you wish to trade in. For example, if you want to trade gold, oil, or American indices, it would be advantageous to open an account in USD. The relevant currency accounts can be opened under the “My Portal” module once you are registered as a customer with Markets. When exchanging between accounts at Markets, it happens at the spot rate, thus avoiding unnecessary exchange costs. Therefore, it typically makes the most sense to transfer DKK to an account in the same currency at Markets from your bank.

Normally, an inactivity fee of 10 USD per month is charged if one does not actively trade on the platform or deposit money for 90 days.

Reporting to the Tax Authorities

Since Safecap, which operates Markets.com, is a foreign-based broker and therefore does not report to the tax authorities, customers are obligated to manage this reporting themselves.

Customers do not need to report individual trades; instead, they should report the overall net result of these for a given tax year. Fortunately, in Markets’ web trader, it is possible to extract an account overview (Account Statement) from the Reports section located at the top right corner, which shows one’s total net result for a specified period, such as a calendar year.

If there’s a need to break down the net result by types of activities, one can also extract a summary showing closed positions divided by individual instruments. This extract can be saved in a web format, after which one can, for example, use Excel to cleverly divide it by types of activities themselves.

We recommend that you contact your local tax authorities for information on how to report capital gains.

Customer service and opening an account

Opening an account with Markets is straightforward and intuitive. During the registration process, you will be asked various questions about your financial situation and previous trading experience. You will be approved for trading as soon as Markets has received the necessary identification and documentation papers, such as a passport and, for example, a bank statement. The information required by Markets does not differ from that required by other trading platforms and banks that comply with current regulations. Upon opening an account, you also gain access to a demo account, which you can use to familiarize yourself with the platform.

You can contact Markets.com’s customer service 24 hours a day by phone on weekdays. You will typically be greeted by English-speaking staff. Customer service can also be reached via email and live chat, which works quite well. Live chat is typically available around the clock on weekdays. For example, you can open a Live Chat in My Portal, or by clicking here.

Markets.com has developed guidelines for any complaints, which you can read more about here. Furthermore, you have the option to complain to a “Financial Ombudsman,” regulated by national supervisory authorities. You can also read more about this at the link provided above.

Markets.com’s customer service is available 24/7 by phone on weekdays. You will typically be greeted by English-speaking staff. Furthermore, customer service can easily be contacted via email and live chat, which operates quite efficiently. We have only experienced quick response times for both email and live chat. Live chat is typically available around the clock on weekdays.

You can find answers to most questions via Markets’ FAQs here.

Transferring Funds to and from Markets

When depositing funds, Markets.com does not charge a transfer fee and accepts various types of credit and debit cards, bank transfers, etc.

For example, it is possible to transfer money via a VISA debit card, which is completely free of charge if you transfer, fx. DKK to a trading account at Markets in DKK. The money will be credited to your account immediately once your account has been verified. The same is often true for other payment cards. Transferring via a “Fast Bank Transfer,” which is a regular bank transfer in your own currency, will typically also not incur fees from your own bank. It will usually take a couple of days before the funds are registered in your account.

It is essential that you transfer from an account or a credit card in your own name, as otherwise, the amount will be rejected.

As mentioned, Markets.com does not charge fees for transfers, but in some cases, your bank might. Markets also does not charge exchange fees if you transfer funds between your various accounts in different currencies. All transfers are thus made at the current spot exchange rate. Therefore, it is generally recommended to open your account in your own currency and transfer money to it, which, at least with debit/credit cards, can typically be done without fees. Afterward, you can exchange currencies without a fee to the currencies you wish to trade in.

If you wish to withdraw your money, it typically takes a few days to transfer money from Markets to your own account or payment card. It is important to note that the principle is that Markets must transfer your funds back to the same account or payment card from which the money originally came. If you have changed banks or if your payment card has expired, you will typically need to submit new documentation of ownership of the account before a payout can take place. Markets does not charge fees. If you transfer amounts in a currency other than DKK, your own bank will probably charge an exchange fee. Since you can exchange currencies without paying a surcharge to the spot rate at Markets, you should exchange any foreign currency to your own currency before transferring your money to your bank.

Security of Deposits

As a private customer (retail investor) with Markets (Safecap), one never risks more than their account balance, even when leveraging positions with CFDs. This is ensured by current EU regulations.

Retail investors are also covered according to EU regulations in the event of Safecap’s insolvency and/or irregularities. Here, one is covered up to 20,000 EUR per investor.

Safecap stores customers’ funds separately from Safecap’s own funds in accordance with the EU’s financial regulations and MiFID through so-called segregated customer accounts. This means that an individual’s account is kept separately from the broker’s own funds in the event of bankruptcy. This provides good security.

As Safecap is subject to relatively strict minimum requirements from the EU regarding the provision of financial services, the company does not differ significantly from other EU providers in the market in terms of the above.

Conclusion

Markets is an excellent broker, particularly for traders seeking a straightforward trading platform with plenty of trading tools and the option to execute trades with low exposure and low trading costs. The charts package and the wide selection of instruments also contribute to making the platform a pleasure to trade on.

Since Safecap, which operates Markets.com, is a foreign broker, customers are obligated to report their net income to the tax authorities and ensure proper documentation is kept for this purpose. Fortunately, the platform offers relatively good options for extracting data for this purpose.

In terms of spreads, Markets is quite competitive compared to its peers. To avoid currency exchange costs from ongoing trading, one can set up currency accounts in the respective currencies they wish to trade in and ensure that f.ex. Danish kroner are transferred to a Danish kroner account at Markets.

For beginners, it provides extra assurance to know that they cannot risk more than their account balance and to know exactly when their positions will be closed if the market moves against them.

For those who would like to try everything out, we recommend using the free demo account before trading with real money.

>>> Create an account with the trading platform Markets here.

When you open an account with Markets, shortly thereafter, you’ll be contacted by a customer support employee, ensuring you’re well-acquainted with the trading platform. The call will likely come from an international phone number.

CFDs are complex financial instruments and come with a high risk of losing money rapidly due to leverage. 79.1% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.