The COT (Commitment of Traders) indicator is a powerful forex trading tool, surprisingly used only by a minority of traders. The indicator is based on the reports published by the Commodity Futures Trading Commission (CFTC) every Friday.

| Try our free forex signal service via Messenger: Click here |

The report from the CFTC can be used by traders to spot potential major trend reversals in the forex markets by ensuring that they are on the same side of the market as ‘the smart money’. In this article, I will give you a simple introduction to the COT indicator and show you how you can use it to your advantage.

What are the CFTC reports?

Every Friday, the Commodity Futures Trading Commission (CFTC) publishes data on futures and options trading activity in the market, segmented into several different markets, including currencies.

The main purpose of the report is to monitor the markets and identify potential situations where there might be market manipulation. In this way, we can see how different market participants are positioned in the market.

What market actors are there?

The market’s participants are divided into three segments:

Non-Commercials: These are large, professional traders, such as hedge funds, commodity traders, and the wealthy. They all have in common that they trade to make money, and they tend to do well in trending markets. But at major turning points, they tend to have long positions when the price peaks and short positions when close to the bottom.

Commercials: These are banks, institutions, and companies that hedge cash positions to protect themselves against changes in exchange rates. Commercials have a good sense of the ‘fair value’ of a currency pair and can have a more sober view of the market because they are not influenced by their emotions in the same way as non-commercials, who are only in the market to make money. Historically, they have been on the right side of major market reversals, meaning they have large short positions close to market tops, and large long positions close to market bottoms.

Speculators: This group consists of ordinary traders who try to make money in the markets. We do not deal with this group due to its small size. The majority of the group loses money over time.

How do you read the overview?

As a forex trader, one primarily looks at futures. The report covers the following currencies:

USD (dollar-index)

Euro

Canadian Dollar

Swiss Franc

British Pound

Japanese Yen

Australian Dollar

New Zealand Dollar

Mexican Pesos

Russian Ruble

You can find the rapport here, and it looks like this:

| Try our free forex signal service via Messenger: Click here |

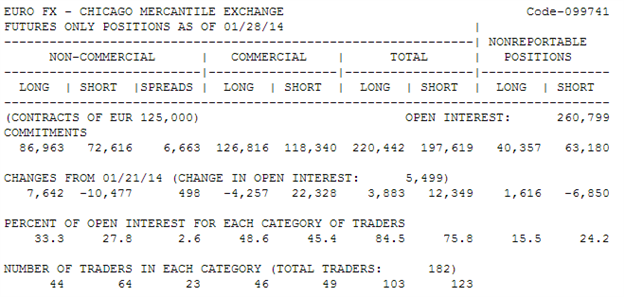

CFTC rapport for euro

Non-Commercials: This is a mix of individual traders, hedge funds, and financial institutions. These are traders who primarily attempt to trade exclusively for speculative gains.

Commercials: These are large companies that use currency futures to hedge their cash positions. They do not engage in speculation.

Long: The number of contracts that have been reported to the Commodity Futures Trading Commission (CFTC).

Short: The number of contracts that have been reported to the Commodity Futures Trading Commission (CFTC).

Open interest: This column shows the number of futures or options that have been entered into, and not yet extinguished through a transaction or a delivery.

Non-reportable positions: These are open positions from traders who do not meet the reporting requirements of the CFTC.

As you can see, the report shows how many futures contracts each segment possesses. To get a better overview, one can use COTbase.

How to use the COT indicator

A good way to use the COT indicator is to look at large divergences between non-commercials and commercials and be on the same side as commercials in trades.

The reason for this is that commercials are not influenced by greed and fear in the same way as ‘non-commercials’ and also know the ‘fair value’ of a currency. They are not in the market to make money, but to hedge cash positions.

Non-commercials trade for financial profit and are influenced by greed and fear. The majority of them lose on their trading. Generally, with a divergence over 10, there is a potential good setup.

Be patient

Since many commercials do not use the forex market to gain financial profit, they can afford to let the market go against them for a while.

Ordinary traders should therefore have patience when using the COT indicator. It takes time for a trend to reverse. Therefore, many recommend using the COT indicator for slightly more long-term positions.

Technical analysis

It’s highly recommended to use the COT indicator in conjunction with technical analysis. It can provide you with better risk-reward trades and increase the odds of success. For example, if you see a good opportunity to trade with COT, then check the technical aspects. If the markets are approaching an important resistance level, they will often test this level.

| Try our free forex signal service via Messenger: Click here |

Conclusion

The COT indicator is a powerful tool that can help you spot major market reversals in the forex market. By observing large divergences between commercials and non-commercials, you can trade on the same side as ‘the smart money’.

It’s important to consider that trend reversals can take some time, so be patient.

Use the indicator in conjunction with technical analysis. It can increase your chances of success.