The path to becoming a profitable trader can be longer than most people think. Many new day traders deposit 10,000-20,000 into their trading account, trade intensively for a few months, lose their money, and never return.

If you’re a new trader who wants to avoid common mistakes, or if you’ve gained some experience and survived the initial phase, here are 15 tips on how to become a better day trader:

- Start small

- Build a strategy and stick to it

- Choose the right platform

- Keep a close eye on stops and targets

- Set rules for yourself, write them down, and follow them

- Keep up with the news

- Learn about a few markets and focus on them

- Educate yourself

- Keep a log of your trades

- Don’t trade too short-term or too long-term

- Trade with the trend

- Be willing to change your mind and direction

- Find a trading buddy

- Analyze the market on multiple time frames

- Don’t chase the market

1. Start small

If you’ve been following the media, you’ve probably heard of day traders who have made millions on a single trade or tens of millions in a year. You may also have an idea that you want to supplement your income relatively quickly with day trading and perhaps start living off it in 2-3 months.

Forget all of this.

If you want to be profitable in day trading and eventually make a living from it, be prepared for a long process. All experience shows that if you break even or manage a small loss after six months, you should be very satisfied. You can’t expect to make money at the beginning. The first six months to a year is a period where you learn about the markets and make all the mistakes that many have made before you.

[table “” not found /]For this reason, it’s a good idea to start with small bets, as there’s no reason to risk your entire trading capital when the chances of making money in this period are incredibly small. If you manage to do well with small bets over several months, you can always increase your bets. Start by trading very small amounts. That way, there’s very little risk of going wrong at the beginning of your trading career. You’ll avoid many problems if, at the beginning of your trading career, you never risk more than 1% of the value of your trading account on a single trade – and preferably less than 1%.

On most trading platforms, including Markets, you can also create a demo account, which we recommend using. It’s a good way to start your trading career without any risk at all.

On the vast majority of trading platforms, including Markets, you also have the option to create a demo account, and it’s a feature that we would recommend using. It’s a great way to start your trading career without any risk whatsoever.

2. Have a strategy, and stick to it

Many inexperienced day traders rely on their feelings and intuition. Read our article on psychology in day trading if you are interested. Despite being relatively new to the market, they may have many opinions about where the market is headed. To be successful as a day trader, you need a much more controlled approach, where you follow one or more strategies that are well-defined.

Psychologically, it can be difficult to adhere strictly to a particular set of rules, because one of the reasons for wanting to day trade is often to have more freedom and better opportunities to express oneself without limitations. However, to survive as a day trader, you must go against your intuition on this point and follow some set rules. It is not by chance that the word discipline appears in all the rules of thumb from skilled day traders. If you cannot adhere strictly to a strategy that you have laid out, it may be that you should try something other than day trading, as it is simply too risky to trade based on intuition.

If you are new to the markets, it can be difficult to develop your own strategies, so we suggest that you start by trading with strategies developed by others. It can be some of the strategies described here in our strategy section ***(Put link to strategy articles)

We would recommend trading one or more of these strategies for the first few months and then developing them yourself, or starting to experiment with your own strategies.

3. Choose the right platform.

As a new trader, it can be difficult to navigate the maze of trading platforms. There is a big difference between platforms, but it takes time to figure out what suits the way you trade. Here on Nordictraders.com, we have reviewed a range of trading platforms on this page: (***link to trading platforms).

If you want to get started quickly, we recommend Markets. The reason is that the platform is quick to get started with if you want to get started immediately.

As an active day trader, you will quickly make hundreds of trades each month, so it quickly becomes important whether the expenses per trade are 5 or 10 dollars. Even if you have already chosen a platform, it may make good sense to read through the reviews and see if there are better and cheaper alternatives, as there is an opportunity to save a lot of money if you can reduce trading costs.

The trading platform Markets (***links to markets) is an easy-to-use platform to start with.

4. Keep good control of stop and target

The discipline of “Money management” is highlighted by most professional day traders as one of the most important tools for achieving good results, and primarily avoiding large losses. Both in day trading and stock trading, it is very common for traders and investors to let their losses run for too long because they hope the situation will turn around. Conversely, there is a tendency to often take profits too quickly to secure their profit.

You need to turn this psychology on its head. If you analyze statistics on day traders’ results, you will see that the best traders do not necessarily have a very high hit rate on their strategies – often it can be around 50 percent, or even below 50 percent. But their losses are much smaller than their winners because they understand how to take the loss as soon as the market goes the opposite way of what they expected. And when they win, they dare to hold onto the good trades much longer than others and ensure that their profitable trades are 2-3 times larger than their losses.

[table “” not found /]If you can integrate the above into your strategy, you have laid the first foundation for becoming a successful trader. The first step is to analyze your trades. Are your losses greater than your wins? Then there is a high probability that you are doing something wrong. Try experimenting with strategies where the risk-reward is at least 2:1 – that is, the potential gain is at least twice as large as the potential loss.

5. Set rules for yourself. Write them down and follow them.

Many skilled traders argue that you should have an almost mechanical approach to your trades as soon as you are in them. It makes sense – and produces better results – to precisely define how to act in certain situations. We, therefore, recommend writing down a set of rules to follow. This can be both before and after entering a trade.

A good example of a rule could be never to move your stop loss in the direction of your loss. When in a losing trade, it can sometimes be tempting to move the stop loss a bit further away because you hope for a market reversal that can turn a losing trade into a winning one. However, if you move your stop loss along the way, you can be fairly certain that the individual loss will grow too large, and you should therefore maintain the stops you have set from the beginning.

Another good rule could be to stop trading for the rest of the day if you have had three losing trades in a row. Often, it can affect future trades quite a bit if you are not completely mentally balanced, as it can be difficult to shake off losing trades if they come in a streak.

[table “” not found /]Contrary to what many believe, there may also be a need to “shake off winning trades.” If you have had three winning trades in a row, you may get an irrational sense that you have figured it all out and that all trades you take after that will have a high chance of winning. In these situations, many traders may be at risk of becoming a little too complacent and end up throwing most of the day’s profits away. Therefore, in the case of a streak of profits, it may also make sense to take a break and remember that you have to respect the market.

Many of the best traders formulate an actual trading plan, where they minutely define how to trade their strategy. This can be a really good point of reference when trading live in the wild and turbulent markets.

6. Keep up with the news

You don’t have to trade on the markets for long before you know that news can move the price quite a bit. Therefore, most day traders stay out of the market during the minutes when major news is expected to be announced. Here at Nordictraders.com, we start the day by looking at forexfactory.com, where you can get a good insight into which news will move the market on a given day. If the news is marked in red, you know that it is highly likely to cause some turmoil in the market.

Forexfactory.com has an easy and clear overview of the announcements that will move the markets during the day. It is particularly events marked in red under the “impact” column that you should take into account, and as a starting point, it is a good idea to stay out of the market while this significant news is being announced. When using Forexfactory, remember to set the time to Danish time.

Many traders try to trade the news and either holds a position over important news or trade immediately after major news has been announced. We cannot recommend this as a starting point, as the market will often be wild and unmanageable, which in certain cases can lead to it going the wrong way very quickly.

If during the trading day, you see major movements that you do not immediately understand the background for, you can try checking Live Squawk, which updates throughout the day

Here one can often find the news that caused the market to move.

7. Learn about a few markets and focus on them.

Market movements can be analyzed through technical analysis, and although there are many similarities among different markets, they each have their own characteristics that set them apart from others. First and foremost, it is important to know when the markets open and are most active in order to achieve the best results.

For example, if you trade the German DAX index, you know that the German stock market opens at 9 am CET and is often quite active in the following hours. After 3:30 pm CE), the market is strongly influenced by developments in the US markets, which traders should also keep in mind.

[table “” not found /]If you want to trade oil, you should be aware that information about Crude Oil Inventories is released every Wednesday afternoon Danish time, and over time you can analyze and build an understanding of how these numbers affect the price of oil.

8. Educate yourself

When you start trading, it is important to also acquire as much knowledge as possible. With so much information on the internet, however, it can sometimes be difficult to know where to start and what is worth your time. Below are some suggestions for what to read to get a better understanding of how the markets work.

We recommend the following books:

Robert D. Edwards, John Magee: Technical Analysis of Stock Trends. A good introduction to technical analysis.

Michael Lewis: Liar’s Poker. A story about life in the financial world of London in the 80s.

Michael Lewis: Flash Boys.. Another interesting book by Michael Lewis is about how billions are made in High-Frequency Trading (HFT).

Fernando Oliveira: Traders of the New Era. Interviews with some of the world’s best day traders, including Danish trader Flemming Kozok.

Martin Pring: Introduction to Technical Analysis. A good introduction to technical analysis.

Jack D. Schwager: Market Wizards. A famous book containing interviews with some of the best traders of the time.

Jack D. Schwager: The New Market Wizards. A newer version of Market Wizards with the same theme: interviews with the best traders.

Lars Tvede: The psychology of finance. A book about the dynamics, psychological phenomena, and concepts that drive international stock trading.

Mark Douglas: Trading in the zone. A book that most traders consider the bible of trading psychology. A must-read for all aspiring day traders.

9. Keep a log of trades

If you want to become good at day trading, you have to learn from your mistakes, and to do that most effectively, you need to keep a log of all the trades you make. Such a log should be constructed as simply as possible, otherwise, many people will tend not to do it.

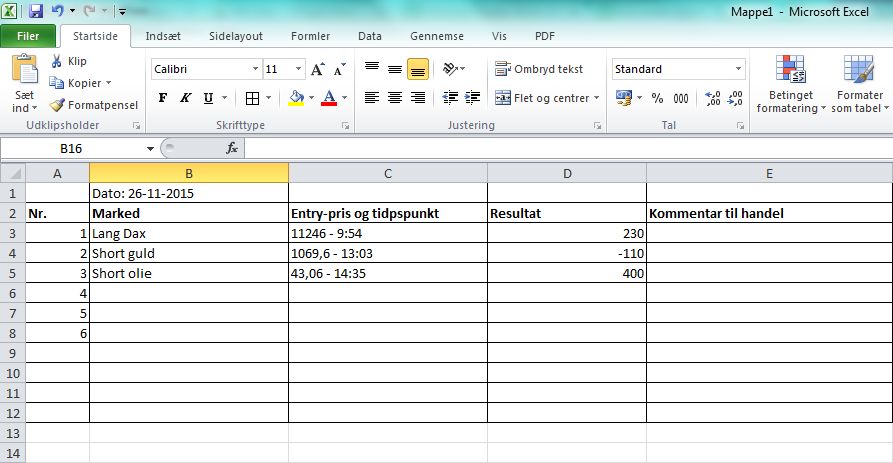

Below is an example of how a simple log of trades could look. For example, you could create your log as an Excel sheet or a Google Doc. The latter has the advantage that you can access the document from different computers.

In this trading log, we have tried to make the log as simple as possible, as it should not become a task that is too heavy to do – otherwise, you will not do it. It may make sense to supplement the log by taking a screenshot of each trade and saving them in a folder, with a folder for each day. On the individual screenshot, you can draw an arrow indicating where you entered the trade, long or short. If you use screenshots, you may want to exclude column C in the above trade log, which is primarily included so you can find the specific trade.

[table “” not found /]Column D indicates profit or loss on the individual trade. You can choose to calculate it in kroner or points. And in column E, you write a brief comment on the trade. Here you should note why you entered the trade, whether you followed your strategy, and possibly what you could have done better. You can choose to analyze the trades during the day, but we also recommend spending half an hour at the end of the day going through all the trades. This time is well spent.

It takes 1-2 minutes to log a trade and take a screenshot. Some may think that it adds up to a lot of time overall, but the time will be well spent. It is often a good idea to have a short break between trades, so you do not just continue on an adrenaline rush from one trade to the next, and the trading log provides a good opportunity to take a short break between trades.

10. Do not trade too short-term – or too long-term

You have probably heard of day traders who achieve great profits in a matter of seconds and minutes. This is a discipline within day trading called scalping. Over time, many day traders have had success with this, but as a starting point, we do not recommend focusing too much on ultra-short trades.

Looking at 1- or 2-minute charts of, for example, the DAX index, they will often be characterized by a lot of noise and a relatively high degree of randomness, making it much harder to make money in the market. Therefore, we recommend strategies that have slightly larger targets and stops than the very short scalping trades with stops and targets, for example, 7-10 points in the DAX index. The reason for this is that these fluctuations lie within the normal “noise” in the price, and it means that the outcome of the trades will be almost random, or 50-50. Focusing on trades that are not ultra-short generally makes it a little easier to achieve good results in current markets.

[table “” not found /]On the other hand, there can also be a risk in holding leveraged positions for a longer period of time, for example, over several days. The longer you are exposed to the market, the more your trades are prone to be affected by random events. If you hold a position over the weekend, news throughout the weekend can affect the market so that it can open in a completely different place on Monday morning than it closed on Friday evening. Therefore, you must have a good handle on stops and losses if you trade over a longer time horizon with leveraged positions

11. Trade with the trend

Many new day traders and investors tend to want to find a bottom or top in the market and then trade in the opposite direction. Even experienced traders sometimes do this. Overall, it is a dangerous strategy to try to predict reversals, and if you are not particularly experienced, you should stay away from it and instead focus on strategies where you trade with the trend.

For example, let’s imagine that the price of gold has been going down all day. As humans, we tend to think that gold is now cheap and that it is an opportunity to buy. In practice, however, the trend often continues far longer than expected. When the price has been going down all day and continues downwards, the big buyers have been scared away, and that creates a self-reinforcing effect.

12. Be good at changing your mind – and direction

A typical way that day traders lose money is that they enter the day with a fixed idea of what the market should do on a particular day. They may think that the DAX index is going up, and therefore they go long, lose the first trade, go long again and lose again, and maybe lose three times before they see that the market is actually doing the opposite of what they expected.

Skilled traders naturally have plenty of opinions on where the market is going, but what sets them apart from less experienced traders is that they can change their minds and change their views on the markets in seconds. Normally, changing your mind quickly is not considered a positive thing, but it certainly is in day trading.

13. Find a trading buddy

On social media, there is a lot of debate about trading and stocks. You can quickly get carried away and end up taking some of the tips that are given or copying trades from others. We would recommend that you focus on analyzing and trading for yourself, rather than copying other people’s trades or advice. If you want to use social media – and it can make sense – we primarily recommend using it to seek information about trading. For example, to ask others for advice on technical analysis, indicators, and so on – and to a lesser extent to discuss and follow other people’s specific trades. Generally, we would therefore recommend using social media in moderation and instead focusing on trading while the market is open. We can also recommend finding a trading buddy – preferably one you can sit with and discuss strategies and specific trades. A good trading buddy can also help you stop if you suddenly become overconfident.

14. Analyze the market on multiple timeframes

As a trader, it’s important to be aware of the bigger trends in the market. Even if you take your trades on a 5-minute chart, it makes sense to also know the development on a daily chart and a medium-term chart such as a 1-hour chart. This way, you get a better sense of where the market is heading overall, and you’ll also get a better overview of trends on the different timeframes.

15. Don’t chase the market

Many beginners may tend to “chase” the market – that is, to try to catch up with the market. Typically, this happens when the market moves sharply in a certain direction. You may sit and regret not getting in earlier. The market may have moved 50 points, and you could have made a profit if you had been in earlier. Out of pure frustration, you now enter the trade late in an attempt to get a little profit out of the move. Unfortunately, this often happens just as the market begins to move sideways or in the opposite direction.

[table “” not found /]A piece of good advice is not to get carried away by the wild moves and to make impulse decisions based on your own intuition about where the market should go. This is a strategy that will almost certainly fail. Instead, you should keep a cool head, possibly take a short break, and wait for the next trading opportunity to arise. There are plenty of opportunities during a trading day, and it takes good patience to wait for the right ones. But if you can do that, you’re one step closer to turning losses into profits.

Do you have any tips on how to perform better as a day trader? Feel free to write them as a comment below the article.