Do you often dream of having bought a stock before a significant price increase? Well, there’s good news for you here because in this article, we present a thoroughly tested strategy that helps you get into a stock before a potential explosion in its price.

| Try our free forex signal service via Messenger: Click here |

Let’s look at how, using this strategy, you could have bought Tesla stock before its significant upswing in late 2019.

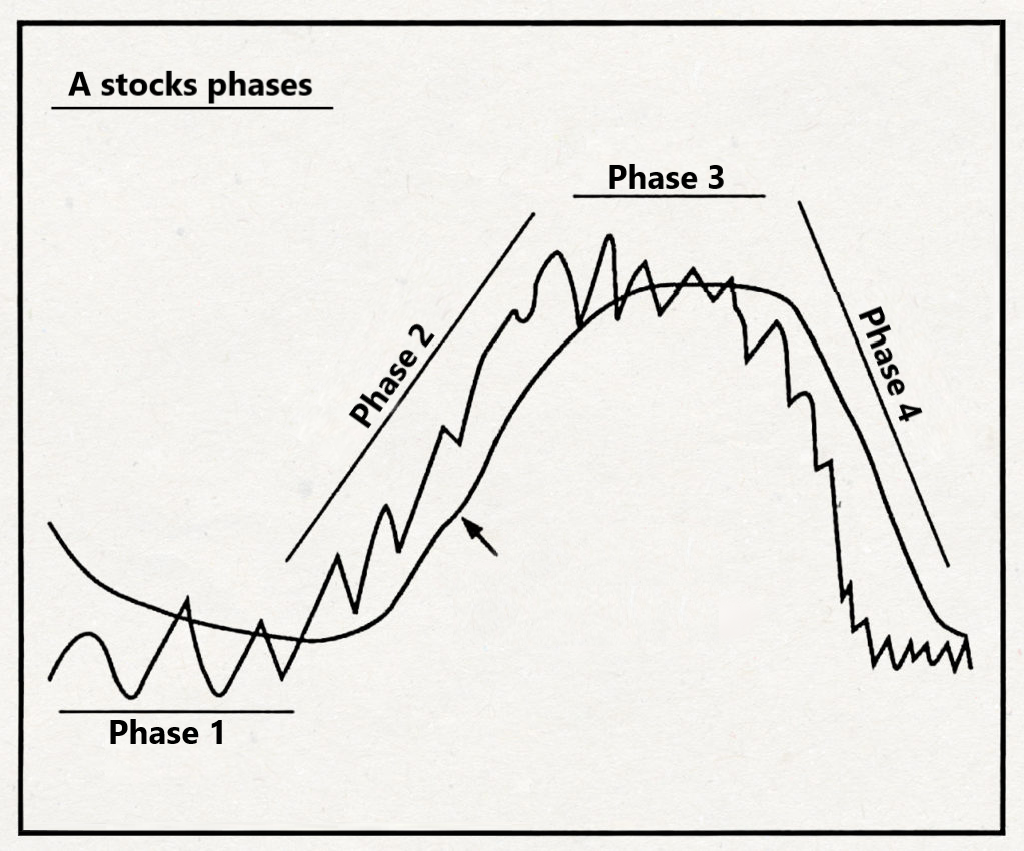

This strategy is described by Stan Weinstein in the book “Secrets For Profiting In Bull And Bear Markets.” Weinstein divides a stock’s price movement into four phases:

- Bottom

- Uptrend

- Top

- Downtrend

These phases can be visualized on a chart as follows:

Let’s look at why it was interesting to buy Tesla’s stock at that particular time. Several factors indicated a potential upward movement at that time.

Factor 1: Price above the 30-week moving average.

Factor 2: The price broke through the trendline/resistance level

The price, in conjunction with the factors mentioned above, needs to break through a specific trendline that has acted as a resistance level for the stock for several months. This is another sign of a potential transition to phase 2.

Factor 3: Larger volume than the previous weeks

Note where the volume was significantly higher than in previous weeks. This indicates a strong buying interest among investors and thus a sign of a potential upcoming rise. Ideally, you would want to see at least double the volume compared to the week before.

Other factors that can strengthen the signal

Weinstein describes some additional factors that you can use to increase the likelihood of success with the signals.

- The longer the consolidation phase, the greater the potential for an upward move when the breakout occurs.

- Buy stocks only from leading sectors. On this page, you can see which sectors currently have the most momentum.

- Buy stocks only when the broad stock market is trending up (e.g., above a 30-week moving average on the weekly chart).

If you follow these criteria, you have good opportunities to get into stocks before they explode in price. However, remember that it is not a magic strategy that always wins. Therefore, it is important to manage your risk using stop-loss orders.

| Try our free forex signal service via Messenger: Click here |

Stop Loss

Stop-loss, for example, can be placed below the candlestick where the price makes its breakout.

The level of your stop loss is individual and dependent on your risk profile and investment timeline.

Take profit

You can take your entire profit or part of it when the price closes below a 30-period moving average:

If you had traded this strategy with Tesla stock, you would have gained a profit of 750%.

If you had traded the stock and followed the take-profit strategy mentioned above, you wouldn’t have needed to hold the stock for more than 1.5 years. The strategy is best suited for swing trading and trades with a medium to long-term perspective.