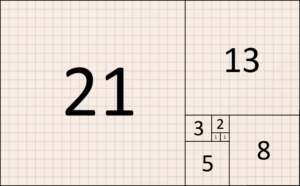

Wedges

Wedges, like trend channels, are essential for understanding market developments and can trigger both buy and sell signals in the same way as trend channels do. Wedges also resemble pennants – read about pennants here. In the chart below, you can see the price development of Yahoo stock over the…

Continue reading