The so-called Gartley pattern is built around a simple ABCD formation but appears slightly more advanced. The Gartley pattern is traded by many professional technical traders who often make their own additions to the classic starting point. One of these traders is the American speculator Larry Pesavento, who has appeared on the Danish radio program about stock trading, Millionærklubben, on Radio24/7.

| Try our free forex signal service via Messenger: Click here |

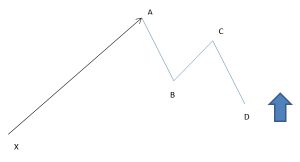

The completion of a Gartley pattern resembles an ABCD formation, but unlike the simple ABCD movement, the Gartley pattern is initiated by an uptrend or downtrend. The ABDC movement should, therefore, be seen as a minor correction on the way up or down in the preceding trend, after which the trader would expect the trend to continue. In the figure below (fig.1), this preceding trend goes from point X to A.

For the Gartley pattern, the same rules apply as for an ABCD pattern, with the following additions:

- Point D cannot be higher/lower than point X.

- Point B cannot be higher/lower than point X.

A Gartley pattern can occur in both upward and downward movements. An upward pattern starts with an upward trend from X to A. A downward pattern starts with a downward trend from point X to A. The subsequent ABCD movement acts as a correction before the trend is expected to resume.

Some traders who trade the Gartley pattern seek confirmation from Fibonacci levels at the reversal points, hoping to add extra confidence to their trades. However, it is relatively rare to find a perfect Gartley pattern that aligns perfectly with Fibonacci retracement levels at the reversal points.

Therefore, some traders choose to place more emphasis on Fibonacci levels and less emphasis on whether the ABCD pattern is entirely perfect. Typically, they compromise on the requirement that the length from point A to point B should be identical to the distance from C to D. Instead, they want to see that Fibonacci levels are hit precisely.

The following video explains Fibonacci and Gartley patterns: