There is always excitement when the earnings season approaches and individual companies are to ‘reveal’ their bottom lines. Often, the price moves sharply up or down if the earnings surprise analysts.

As a trader, it can be difficult to trade during the earnings season. Still, there is a sound trading method that has been described by Brandt and Kishore (Fuqua School of Business, Duke University).

| Try our free forex signal service via Messenger: Click here |

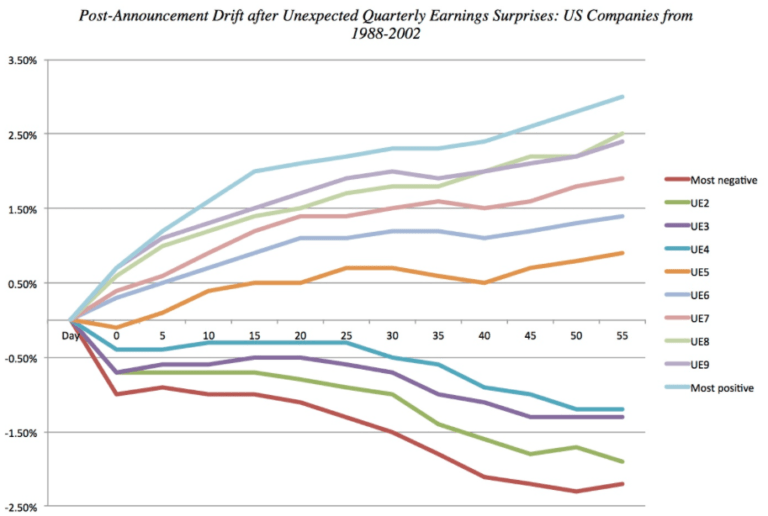

The idea is to look for earnings reports that create big surprises for analysts. The study shows that the associated stocks tend to move in the same direction as the surprise (positive or negative) for up to 60 days after the earnings announcement. This tendency is also called Post Earnings Announcement Drift (PEAD).

Let’s look at an example:

The American company Twilio Inc looked like a loser leading up to its earnings report in February 2018. In the months prior, Twilio had hit an all-time low and investors had almost given up on the company. But then the company presented a positive earnings report, and the stock rose by more than 16% the following day. But the positive trend was not over. In line with the PEAD concept, the stock continued to rise in the following months, increasing by almost 80% from February to March. If you had bought 10,000 kroner worth of Twilio papers on the the trading platform Markets with a leverage of 5, you would have thus made 40,000 kroner in a month.

The flexibility of the PEAD strategy is that it can be used both ways. If the earnings report is a positive surprise, you can buy the stock, and if the report is disappointing, you can short the stock. According to the Brandt and Kishore study, the strategy is capable of generating a return of about 12.5% annually.

If one wants a methodical approach to the strategy, one should make a criterion for when a new earnings figure can be called a surprise. For this, Brandt and Kishore have created a formula based on the earnings report itself.

It is unclear why PEAD occurs, but one explanation may be that it takes some time for the market to absorb the news from individual companies. Typically, both private investors and various funds will only make a decision on a possible purchase/sale in the following days, and on that basis, the stock will gradually rise or fall even more, depending on the direction of the news.

To summarize:

Buy stocks in companies that offer the biggest positive surprises in their earnings reports. Or go short on stocks that offer the biggest negative surprises in their earnings. The stocks can be held for up to 60 days. The study is based on stocks that had an initial share price of more than 5 USD.

You can find companies’ earnings dates here.