AvaTrade is an EU-based broker, licensed in Ireland. Since 2006, AvaTrade has provided hundreds of thousands with the opportunity to trade CFD contracts at competitive prices and high security.

There are several reasons to consider AvaTrade:

- Very user-friendly web trading platform, which makes it easy for beginners to get started.

- Access to a free demo account so one can familiarize themselves with the platform.

- A wide range of products with competitive prices.

- The ability to leverage and short sell in the market via CFD products.

- Retail investors are covered by EU investor protection rules, for example, with negative balance protection.

- Retail investors are covered by Irish legislation regarding compensation for losses with the broker (up to 20,000 EUR).

You can create an account here or read more below in our detailed review of the broker. You can also read more about why you should only be a customer of EU-approved brokers here.

If you are new to active trading, we recommend that you participate in one or more of the free online courses that we at NordicTraders.com offer. Participation in these courses, which among other things prepare you well for active trading, is initially free, but as a customer of AvaTrade, you get access to even more material.

TABLE OF CONTENTS

About AvaTrade

AvaTrade, based in Ireland, has been offering trading in CFD products since 2006. AvaTrade holds a European license as an investment company and is regulated by the Central Bank of Ireland under Irish law. In addition, AvaTrade has licenses worldwide to offer its services on a global scale. Currently, AvaTrade has 400,000 registered traders worldwide, who place more than 3 million trades each month.

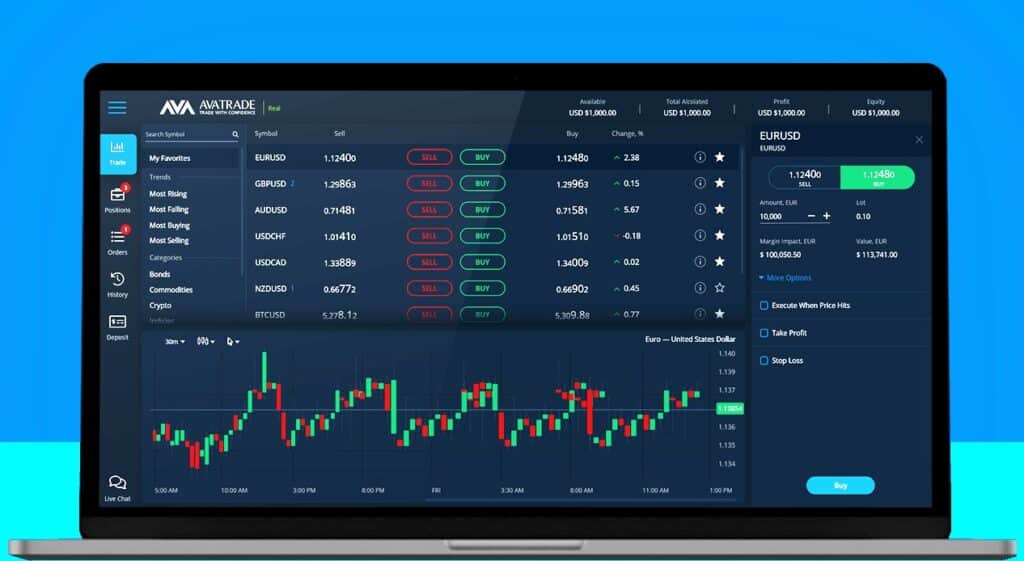

The online trading platform WebTrader

WebTrader is AvaTrade’s version of a simple and very user-friendly web-based trading platform, as per the image above. The platform is both intuitive and informative at the same time, making it easy for beginners to get started with trading.

The platform is modular and relatively fixed in layout, but it allows for graphs to be pulled out into separate windows, which creates a really good overview for analyzing price movements. Here, one can also see any open positions directly on the graph.

On the left side of the screen, at the top of the burger menu (the icon with the three lines), you’ll find various options and account details. Here, you can open multiple accounts, for example in other currencies, MT4/5, or demo accounts. Just below under ‘Trade’, you can access the price lists, where you can also trade and find information about individual instruments. There are different trend-based lists where you can follow what is currently moving significantly. Further down, you can click on the different types of assets to find the specific types of instruments you are interested in following. You can also search for individual instruments either by short name or full name. At the top, there is a Favorites list, which you can customize. You add instruments to this list by clicking on the star to the right under each instrument. You can then easily customize the favorites list in the order you prefer.

Under ‘Positions’, the third icon, you can find your open positions (the number of open positions is shown on the icon), see the current status, modify stop loss and take profit, and close your positions. Further down, ‘Orders’ shows pending, unexecuted orders, and under ‘History’ you can look back in time and see summaries of previous positions.

Furthermore, there is access to a wide range of different services such as technical signals, news, key figures, recommendations, etc. You can also find access to AvaTrade Academy with a wide range of instructional videos and texts on how to get started with trading and how the markets work. Finally, you can open a live chat by clicking on the Chat symbol at the bottom left.

At the top of the platform, as shown in the image above, you can monitor key financial figures relating to your account, including balance, available margin (Free Margin), used margin, profits or losses from currently open positions, equity, and Margin Level. The last metric, Margin Level, indicates the margin level, i.e., used margin in relation to equity. If this is below 100%, you cannot open new positions, and if it drops below 50%, your open positions will be automatically force-closed.

How to trade

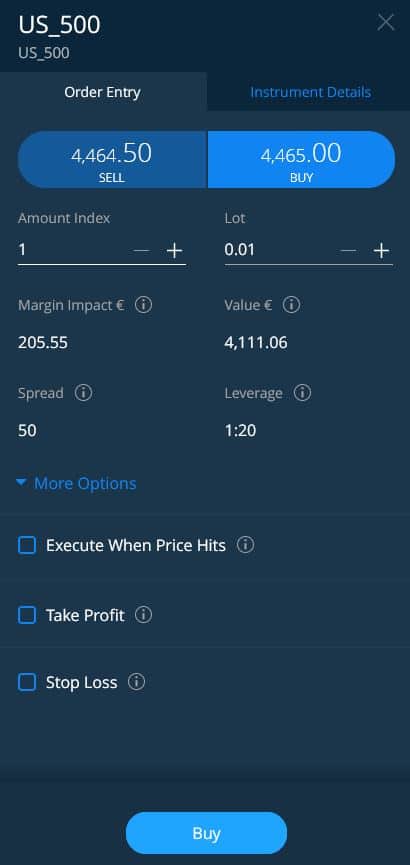

Under the ‘Trade’ button on the left side, you gain access to various price lists, and you can also search for a specific instrument by typing its name or symbols. Then, for the relevant instrument, you choose ‘Buy’ if you want to purchase (go long) or ‘Sell’ if you want to sell (go short). On the right side, an order window then appears for the selected instrument.

Under ‘Order Entry’, you specify the number of units (amount), for example, shares if it concerns stocks. Each instrument is also denoted in lots (contracts). Margin Impact indicates the margin requirement in the currency in which your account is denominated relative to the chosen number of units. Value represents the exposure of the position. For instance, if trading the SP500, the margin requirement is 5% of the exposure you wish to undertake. Therefore, 1 lot of SP500 equates to approximately 4.465 USD in exposure, with an associated margin requirement of about 5% of this, or approximately 220 USD. Be aware that you are settled in the currency your account is denominated in. If it is in EUR, for instance, an instrument traded in USD will be converted to EUR. The instrument’s current spread and leverage level (Leverage) are also displayed.

Under ‘More options’, in connection with the trade, you can specify a Take Profit (TP), which automatically closes a position when a given price target is hit, thereby securing your profit. You also have the option to manage the risk of your position by setting a Stop Loss (SL), which causes the position to be automatically closed at a specified level if the price moves in the wrong direction. Both TP and SL can be set in terms of price level or as a specific result in the currency, the account is denominated in.

If you check the ‘Execute when Price Hits’ option, you can place a limit order in the market, which will be executed when a specific price level is reached. The limit can be set both above and below the current price. You can set a specific date for the order to expire.

Under the ‘Instrument Details’ tab in the order window, you can find the Lot Size and the corresponding minimum Trade Size. In the same tab, at the top, you can see how AvaTrade’s other customers are positioned in the instrument, currency, spread, leverage, and margin requirements. You can also see the interest costs you will have to pay, calculated per annum, for both long and short positions.

You can watch the videos below on how to set up your AvaTrade account and start trading.

Charts

The graph view is initially displayed at the bottom. If you find the graph a bit too long, you can adjust the size simply by dragging it with your cursor. You can also split it into two, which are displayed in continuation of each other, for example, with different time frames or indicators. The latter requires that you have not selected ‘synchronize’ on the graphs, so you will need to remove the check mark from the same place where you choose multiple graphs. By pressing the two arrows at the top right of the graph, it is maximized on the screen. This way, you can have up to four graphs displayed at once. If you press the small square next to the instrument name on the left instead, the graph is moved to a separate window, which you can display on an external screen. You have the option to open several graphs, for example, with multiple time frames on the same instrument or for different instruments. The graph view is initially linked to the instruments you click on in the price lists.

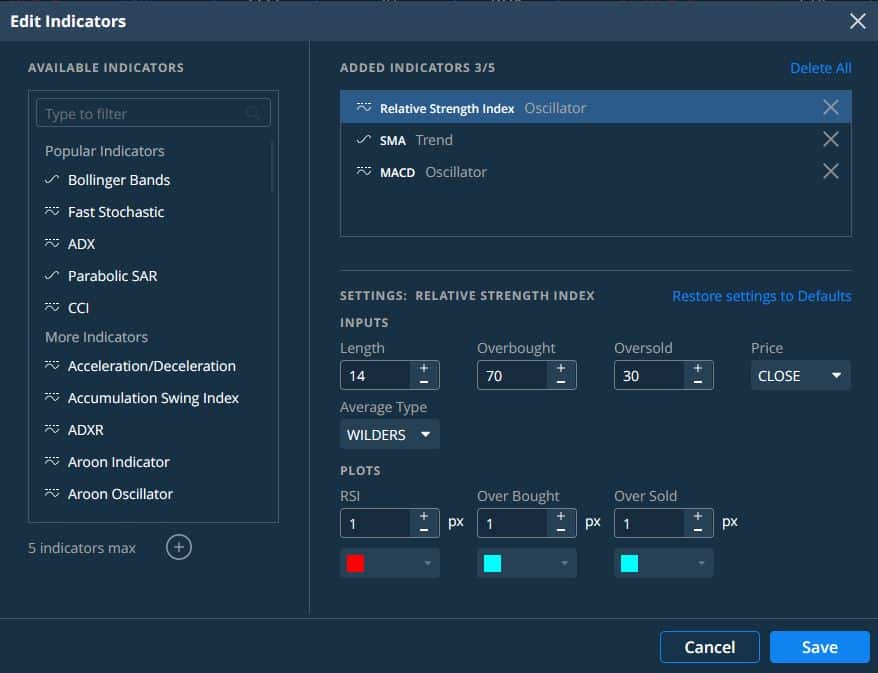

You can select time frames ranging from 1 minute up to 1 month. There is price data available for up to 8 years back. The chart can be displayed with candles, bars, or lines. You can choose a crosshair for the mouse if you want to have relevant levels for individual bars and any applied indicators shown in a small box.

Access is available to no fewer than 90 different indicators on the chart, so there is something for everyone. You can apply up to 5 different indicators at a time. However, due to the simple interface, it is not recommended to apply too many indicators at once.

You apply indicators by clicking on the ‘f(x)’ icon at the top of the chart. Then you select the indicator or indicators you want to display, with the parameters you prefer.

You also have good options for drawing on the chart, such as trend lines, channels, arrows, and text, as well as applying various Fibonacci tools and pitchforks.

If you have an open position in a given instrument, this is displayed on the chart along with any associated Take Profit and Stop Loss levels, as well as the opening price. You can directly change these levels on the chart by dragging the lines up or down, which is quite smart. You cannot directly close the position if the chart is displayed in full size. Instead, you should click on the small cross in the position list displayed above the chart.

Analysis Tools

Once you have deposited money into your account, you gain access to the services Signals, which provide technical buy and sell signals, News, offering global news and key figures, and Discovery, which gives access to various analyses of the global markets. See more about the possibilities below.

Access to Accounts

In the Burger menu at the top left under ‘My Accounts’, you can find an overview of all your accounts, and open new accounts, for example in other currencies, MT4 or 5, or demo accounts. You can also access reports (Account Statements) for custom periods. Right under ‘My Accounts’, you’ll find ‘Payments’, where you manage deposits and withdrawals, and transfers between your own AvaTrade accounts.

All in all, AvaTrade’s WebTrader works well with a simple and intuitive layout. Initially, when you open a real account, the default is that you are assigned an MT5 account, which you can trade on both in WebTrader and in the MetaTrader 5 platform, described in more detail below. It is also under ‘My Accounts’ that you open new accounts, for example in other currencies, MT4, DupliTrade, or demo accounts.

In addition to WebTrader, there is also a corresponding mobile-based version, AvaTradeGO, which you can read more about below.

Other Trading Platforms and Copy Trading

AvaTrade offers, in addition to the above-described browser-based WebTrader, a mobile app, AvaTradeGO, for Android and iOS. In addition, access to third-party platforms MT4 and MT5 is provided. Furthermore, there is an opportunity for copy trading via DupliTrade. Finally, AvaOptions is available for the more advanced traders. The various options are described in more detail below.

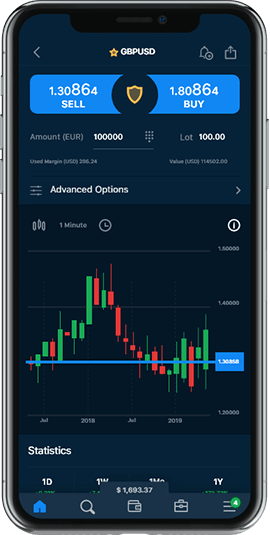

AvaTradeGO

The mobile app is, of course, particularly useful when you are on the go. As an active trader, you need to be able to easily access your existing positions or be able to react to particularly favorable situations. Therefore, having access to a functional mobile app is a must. AvaTradeGO is a simple and user-friendly app that offers both the basic necessary functions and the possibility for in-depth market analysis. In addition to trading, you have access to price information, watchlists, advanced chart views, news, signals based on technical analysis, and more. You can access all your different accounts and demo accounts, where you can also withdraw and deposit money.

All in all, the mobile app can be said to be an excellent supplement to the web trader when you do not have access to the latter.

MetaTrader 4 and 5

It is possible to link your AvaTrade account to the external trading platforms MetaTrader (MT4 and MT5). Initially, MT5 accounts are the same ones you trade on via AvaTrade’s own web-based browser, which has been thoroughly described above. Therefore, you will be able to find individual positions both in the MT5 platform and AvaTrade’s own platform. Trading via MT4 and MT5, among other things, allows you to use Expert Advisers (EAs), which are automated algorithms that trade according to set parameters and conditions, etc. You can read more about Expert Advisers here.

At the same time, MT4 and MT5 are among the most widely used trading platforms, as many brokers offer the option to use these. This makes it easier to switch between different brokers, as the trading platform remains the same and only the provider, the broker, is replaced. If you are relatively new to the trading world, MT4 and 5 might not be the best place to start, as the platforms both graphically and technically offer many possibilities. In any case, it is advisable to spend a considerable amount of time learning how they work. Both MT4 and MT5 can be downloaded for PC and Mac, and they can be run through a browser solution. You can open the accounts you want in the WebTrader under the burger menu. You can also open demo accounts here.

You can watch the following video on how to download MetaTrader and connect it to your AvaTrade account:

Copy Trading via DupliTrade

DupliTrade is a transparent and user-friendly trading platform that allows you to automatically copy traders’ transactions directly onto an MT4 or MT5 account under the auspices of AvaTrade. You must deposit a minimum of 2000 USD to gain access to copy selected traders.

Read more about DupliTrade here. Or open an account with AvaTrade right away.

AvaOptions

As something somewhat untraditional for a CFD broker, AvaTrade also offers advanced options trading, primarily based on forex, but other asset types are also included. Through the AvaOptions trading app, which can be downloaded for iOS and Android, you can trade a wide range of options strategies. AvaTrade offers courses about options strategies, which require a fair amount of insight before one delves into these types of products.

Read more about AvaOptions here.

Products

AvaTrade primarily offers trading in CFD products across approximately 1000 different instruments, including forex (currency pairs), stock indices, commodities, ETFs, individual stocks, cryptocurrencies, and some government bonds. Additionally, it offers options trading in a wide range of instruments.

When trading with contracts for difference (CFDs), it means that you do not own the underlying asset, but rather a right to participate in the asset’s price movement for the period you own the CFD. The advantage of this is, among other things, that you can both go long in the market, i.e., buy, if you believe an asset will increase in value, and go short if you believe an asset will decrease in value.

It is important to note that when trading CFDs, you are engaging in leveraged trades. This means that to trade a given exposure, you only need to provide a specified margin, i.e., security, which depends on the asset you wish to trade. The size of this margin and thus the leverage factor depends on which underlying instrument (asset) you are trading.

For example, you can leverage the American Dow Jones index 20 times, while individual stocks can typically be leveraged 5 times. Trading CFDs, precisely because of the leverage element, is not necessarily suitable for everyone, so it is strongly recommended that you thoroughly understand how these types of products work.

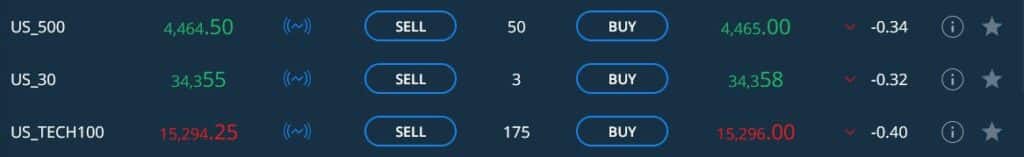

Indices

It is possible to trade approximately 20 major and minor stock indices. The margin requirement is 5% for major indices, such as the three major American indices and the largest European indices, corresponding to a leverage of 20 times, while for smaller indices it is 10%, corresponding to a leverage of 10 times, for example, for Hang Seng (HK_50), China50 (CHINA_A50), and the American dollar index (DOLLAR_INDX). Most stock indices can be traded in fractions, typically down to 0.1 of a lot, for instance, for US_TECH100 (which reflects the American technology index Nasdaq 100), which is currently trading at around 14,000 USD. This results in the minimum exposure being down to about 1,400 USD with an associated margin of about 70 USD.

Commodities

Trading is offered in approximately 20 different types of commodities including precious metals, energy, and agriculture. Most commodities are traded with a leverage of 10 times, except for gold, where it is possible to leverage up to 20 times. In terms of energy, you can trade, among others, US Crude oil, Brent oil, heating oil, and natural gas. Among agricultural commodities, there are options like cocoa, coffee, soy, sugar, wheat, etc. Among metals, for instance, gold, silver, and copper are available for trading.

For instance, you can trade US crude oil (CrudeOIL) futures down to 10 contracts at a time, which provides an exposure of approximately 400 USD with an associated margin requirement of 10% or 40 USD, equivalent to a leverage of 10 times. The minimum spread for oil is indicated to be 0.4 USD. Gold can be traded down to a spread of 0.29 USD, where the minimum investment is 1 contract (i.e., 1 ounce) at around 1.900 USD with a 5% margin, equivalent to approximately 80 USD. Thus, gold can be leveraged up to 20 times.

Currency pairs

Regarding currency pairs, more than 50 different pairs are offered, including all the major currencies as well as many minor and so-called exotic currencies. As a general rule, it is possible to trade around the clock with few exceptions.

The margin requirement for the major currency pairs is 3.33%, which corresponds to a leverage of 30. As for the minor currency pairs, the margin requirement is 5%, equivalent to a leverage of 20.

The currency pair EUR/USD can be leveraged with a factor of 30 and can typically be traded with a fixed spread of 0.9 pips. The smallest possible exposure will be 1,000 base units, for example, 1,000 USD when trading the EUR/USD currency pair, so it is possible to trade currency with low exposure.

Individual Stocks

If you wish to trade individual stocks, this is done via stock CFDs, and at AvaTrade, you can trade just under 600 selected stocks of a certain size, primarily American and a handful of European ones.

When trading stock CFDs, the typical margin requirement is 20%, which corresponds to a leverage of 5. No commission is charged in connection with the trade. Instead of a commission, AvaTrade calculates an addition to the spread at which the individual stocks are currently traded on the exchanges where they are listed. Despite the addition, it is not necessarily more expensive to trade most stocks, as no commission or other fees are charged. This is particularly the case if you trade a small number of shares with low exposure. Often you can trade down to one unit of a given stock, for example, 1 Apple CFD share, which is currently trading at about 192 USD, resulting in an associated margin of about 38 USD (20%), or Alibaba, currently trading at 83 USD, requiring a margin of 17 USD. You often have to trade 10 at a time for stocks traded at lower price levels.

Cryptocurrency

AvaTrade various major cryptocurrencies with a typical leverage of 2. All cryptocurrencies are traded as CFD contracts, so it is not necessary to own a wallet. Therefore, you are not exposed to the risk of being hacked or losing your assets in other ways (apart from normal market fluctuations, of course).

Regarding Bitcoin, the margin requirement is 50%, and it is possible to trade down to 0.1 Bitcoin at a time, which currently corresponds to an exposure of about 1500 USD with an associated margin requirement of about 3000 USD. For other cryptocurrencies such as Ethereum, Dash, Litecoin, Ripple, etc., the margin requirement is also 50%, meaning that these are leveraged by a factor of 2.

If you hold your position overnight, a relatively high financing cost is charged for certain cryptocurrencies, meaning that it is not attractive to hold crypto positions over longer time horizons. It is possible to trade cryptocurrencies around the clock throughout the week, but not on weekends.

Costs

Generally, AvaTrade offers relatively low minimum spreads when trading CFD-based products. AvaTrade does not charge commissions or anything else in connection with trading, which can especially make it attractive to trade stocks in smaller position sizes, as mentioned above.

If one keeps their CFD positions open for a longer time (i.e., ‘overnight’), financing costs (swaps) are charged, where the size depends on the product type and the currency in which the product is traded. The recent rise in interest rates has naturally also reflected in the interest levels that brokers charge. Often, however, the interest on short positions will be very low and even positive in some cases. Currency crosses, commodities, and stock indices typically have lower interest costs than, for example, stocks and cryptocurrencies. The specific interest costs for each instrument can be seen under the ‘Instrument details’ tab in the order window when logged onto the trading platform. The interest rate stated here is annual in percentage.

If one is inactive on their account by not trading for 3 months, an inactivity fee of 50 USD is charged for every third month of inactivity. If one does not trade for a whole year, an administration fee of 100 USD is also charged. Therefore, if one is not actively trading for a period, it is advisable, for example, to set a reminder in one’s calendar to remember to make a trade, for instance, once a quarter. It is possible to make trades with low minimum exposure, for example in the currency cross USDJPY, where one only needs to put down 33 USD in margin, or trade an Alibaba CFD share for 17 USD. One can then close the position shortly after if one does not wish to be exposed for a longer time.

You can read more about AvaTrade’s costs here. Or you can open an account right away.

News, services, and education

AvaTrade offers a wealth of options for financial news, signals, recommendations, etc. Certain signals require that money be transferred to one’s account before access to data is granted. This is the case, for example, with signals from Trading Central, which are based on technical analysis of a wide range of instruments. Read more about Trading Central at AvaTrade here.

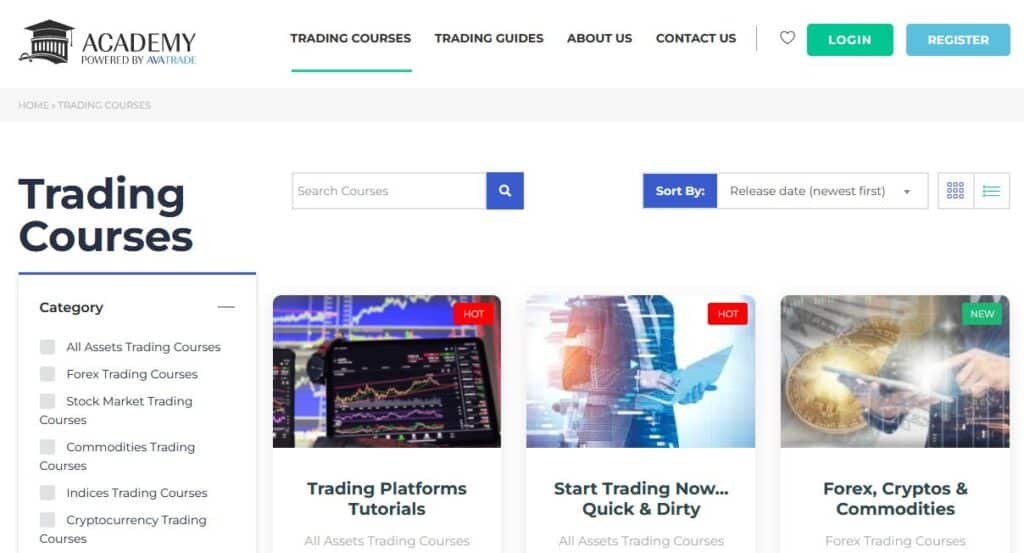

In terms of education, there is, among others, Ava Academy, which consists of a wide range of interactive articles, videos, PDFs, etc., aimed at helping both new traders get started and more experienced ones advance in the trading world. Read more here about the extensive opportunities.

Safety of Deposits and Regulation

AvaTrade stores customer funds separately from its own funds in accordance with the EU’s financial regulations and MiFID through so-called segregated customer accounts. This means that customer funds are kept separately from the broker’s funds in the event of bankruptcy.

In addition, in the event of AvaTrade’s bankruptcy and irregularities, private customers’ funds are insured for up to 20,000 EUR per customer under Irish law.

Since AvaTrade is subject to strict minimum requirements from the EU regarding the provision of financial services, AvaTrade does not differ significantly from other providers in the market concerning the above.

As EU regulations prescribe, AvaTrade guarantees protection against a potential negative account balance, which means that it is not possible to lose more than one’s account balance. Before a customer might come into this situation, AvaTrade is obligated to make margin calls and forcibly close open positions. The risk of this typically exists during large price movements, for example, overnight, when certain markets might be closed, or if one, so to speak, stretches the bow too tight and overexposes oneself in relation to one’s account balance.

Since AvaTrade is a foreign-based broker and therefore does not report directly to your tax authorities, customers are obligated to undertake this responsibility.

One does not need to report each trade they make, but rather the net result of these for a given tax year, as well as an account balance. Fortunately, it is possible in the web trader under the user menu at the top left to extract a trade history and balance overview, which shows one’s total net result for a given period, for example, a calendar year. It is also possible to pull various reports in MT4 and MT5.

Customer Service

One can easily get in touch with AvaTrade’s customer support via live chat, email, or by calling a Danish phone number or via WhatsApp. See more here.

One can open a live chat when logged into the Webtrader by clicking on the small Chat icon in the bottom left corner. In the same place, one can start a WhatsApp conversation if they prefer that. It will most likely be English-speaking staff that one comes into contact with.

How to open an account

You can create an account by clicking here. Initially, one registers with an email and a password. Afterward, as required by law, one must provide information about their experience with securities, wealth, and income conditions, and answer some questions regarding knowledge of trading with leveraged instruments, etc.

In accordance with anti-money laundering regulations, one must also provide legitimate identification. This can be done, for example, with a copy of a valid passport or a driver’s license (both front and back need to be uploaded). Additionally, one must provide documentation of their address, for example, in the form of a bank statement, electricity bill, or other documents where their name and address appear. This document must be no more than 6 months old.

Once you have provided the relevant information and have been approved by AvaTrade to trade, you need to transfer money to your account. The minimum amount to deposit is either 100 USD or 100 EUR via a payment card (which is the fastest method) or via a bank transfer (which can take up to 7 banking days). However, it is advisable to consider depositing at least, for example, 500 or 1000 USD (or EUR), as otherwise, you risk limiting your opportunities to trade instruments and respond to market fluctuations. But of course, it is entirely up to you how much risk you want to take on. You choose in advance whether you want your account denominated typically in USD or EUR. Unfortunately, it is not possible to have an account in DKK. This is partly because the account you open is used both in AvaTrade’s web trader and on the external MT5 platform, which only supports the major currencies. At any time in the web trader, you can also open accounts for MT4, other currencies, demo accounts, etc.

When you want to withdraw money from your account, it is done via the user menu in the Webtrader, where you select Withdraw and the method of transfer. As a principle, the money must be paid out in the same way as it was deposited. Typically, it can take up to 10 banking days, although it is often considerably faster if a payment card was used for the deposit. If you have changed banks or payment cards since the original transfers, you should contact customer service to have this registered.

Read more about deposits and withdrawals as well as the approval process here.

Conclusion

AvaTrade is an excellent broker, especially for traders who want an easy-to-navigate trading platform with plenty of analysis options and trading tools, and the ability to make trades with low exposure and low trading costs. The different charts available and the range of instruments also contribute to making the platform a pleasure to trade on.

As an EU-based broker, AvaTrade is subject to stringent legislation, and as a retail investor, you are therefore well-positioned. If you are a beginner, it will provide extra reassurance to know that you cannot risk more than your account balance and that you are insured for up to 20,000 EUR in case of financial difficulties at AvaTrade.

Since AvaTrade is a foreign-based broker, you are obligated to report your net result and wealth information to the tax authorities and ensure that you keep proper documentation for this. Fortunately, the platform provides relatively good options for extracting history for this purpose.

If you would like to try out the trading platform, we recommend using the free demo account before trading with real money. You can also use a demo account to make yourself familiar with the platform and test some strategies.

You can open an account with AvaTrade here.

Q&A

What is AvaTrade?

AvaTrade is an EU-based broker that, with a license in Ireland, offers CFD trading in a wide range of asset classes at competitive prices on various user-friendly trading platforms.

Is AvaTrade safe?

Yes, AvaTrade is approved as an investment service provider by the Irish authorities and is thus subject to strict EU-based requirements for the protection of retail investors. For example, as a retail investor, you are covered for up to 20,000 EUR in the event of bankruptcy or irregularities at AvaTrade.

What can you trade with AvaTrade?

AvaTrade offers CFD trading in hundreds of instruments based on individual stocks, stock indices, commodities, currency crosses, and cryptocurrencies.