PKS is also known as The Stochastic Slow. It is simply a Stochastic oscillator that is slower than a normal Stochastic. This oscillator compares a product’s most recent closing price with the price range it has moved in over a period. The idea is that a stock appears weak if the closing price is in the lower part of the range, whereas the stock appears strong if the closing price occurs in the upper part of the range.

| Try our free forex signal service via Messenger: Click here |

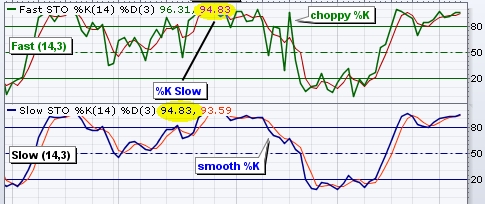

The stochastic oscillator moves within a range between 0 and 100, and it usually contains two lines. The first line is called %K, which is the basic element of the indicator, and it is calculated based on the description above. The second line is called %D, and it is simply a moving average of %K. This line is considered the most important of the two, and the one that provides the best signals. For this reason, the %K line is often omitted.

The difference between a slow and a fast Stochastic oscillator is that the slow one has a %K line that is smoothed using a moving average. This means that the PSK oscillator is less sensitive than a normal Stochastic oscillator.

The Stochastic oscillator was developed by George C. Lane in the late 1950s, and it is today among the most used indicators. Both among private and professional traders.