In the fast-paced world of day trading, staying informed and organized is not just an advantage—it’s a necessity. With the myriad of tools available, it can be overwhelming to choose the right one to track your trading activities effectively. Enter Myfxbook, a powerful and user-friendly platform that stands out in the realm of financial trading. This comprehensive tool is not just a way to monitor your trading accounts; it’s a gateway to a community of traders, a wealth of analytical insights, and a platform for growth and learning.

| Try our free forex signal service via Messenger: Click here |

In this article, we’ll delve into the nuts and bolts of how to use Myfxbook to track your day trading activities. Whether you’re a novice trader looking to understand the basics or a seasoned veteran aiming to optimize your strategies, understanding how to leverage Myfxbook can transform your trading experience. From setting up your account and linking your trading platforms to analyzing your performance and engaging with the community, we’ll guide you through every step to ensure you harness the full potential of Myfxbook in your day trading journey. So, buckle up and prepare to unlock the power of one of the most influential tools in the world of forex trading.

What is Myfxbook?

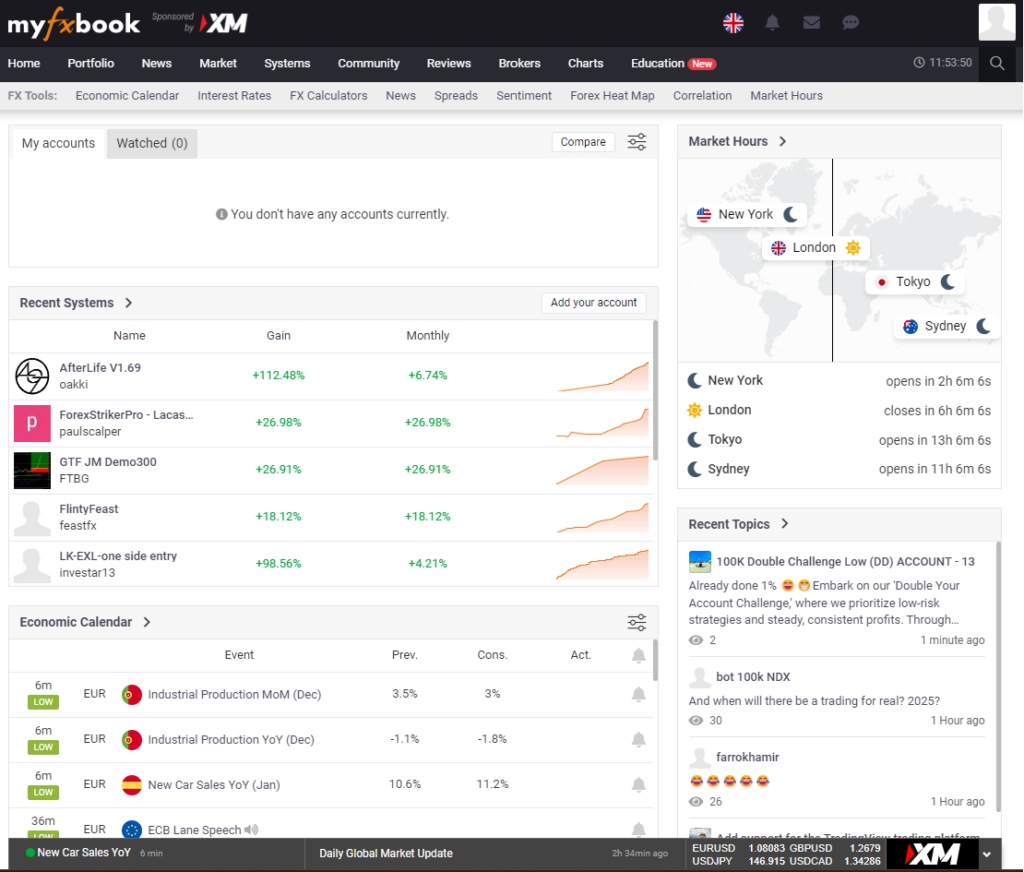

Myfxbook is an advanced, user-friendly platform that has revolutionized the way forex traders analyze their performance and interact with each other. At its core, it is an online automated analytical tool designed for forex traders, offering a comprehensive suite of features that cater to various aspects of trading. The platform provides real-time information, detailed analysis, and a community forum for traders to exchange ideas and strategies.

One of the standout features of Myfxbook is its ability to automatically sync with your trading accounts, providing a transparent, in-depth view of your trading activities. Traders can track their account’s performance in real-time, analyze trade history, and monitor their growth, losses, drawdowns, and risk metrics. This level of detail extends to the ability to scrutinize individual trades, understand trading patterns, and make informed decisions based on accurate statistical data. Myfxbook’s commitment to transparency and precise analytics makes it a trusted tool among traders worldwide.

Beyond its analytical capabilities, Myfxbook fosters a vibrant community of forex traders. It serves as a social hub where traders can share their trading strategies, experiences, and insights. The platform’s social aspect is enriched with features like copy trading, where users can mimic the trades of successful traders, and trading contests that add a competitive edge to the trading experience. This communal environment, combined with the robust analytical tools Myfxbook offers, creates a holistic platform that empowers traders to learn, improve, and succeed in the dynamic world of forex trading.

Myfxbook offers a suite of tools and features that are invaluable for forex traders seeking to stay informed and optimize their trading strategies. Here’s a detailed look at some of the key functions:

- Economic Calendar: The Economic Calendar is a crucial tool for forex traders. It lists the dates and times of all major economic events, announcements, and government reports that can impact currency markets. This tool helps traders anticipate market movements and manage their strategies accordingly. It includes detailed information about the event, as well as forecasts and previous outcomes, enabling traders to assess the potential impact on their trades.

- Market Holidays and Hours: This feature provides traders with a comprehensive schedule of market holidays and trading hours for forex markets around the world. Understanding market hours is crucial for planning trades, as the opening and closing of different markets can significantly influence currency pair volatility. This tool helps traders avoid unexpected market closures and plan their trading activities during times of peak liquidity.

- Interest Rates: Interest rates are among the most influential factors in the forex market. Myfxbook’s Interest Rates feature provides traders with up-to-date information on the interest rates set by central banks of major economies. This information is vital for traders as changes in interest rates can lead to significant movements in currency pairs. Traders can use this data to predict market trends and make informed decisions on their trades.

- Different Forex Calculators: Myfxbook offers a range of forex calculators designed to help traders manage their risk and calculate potential profits or losses. These include:

- Pip Calculator: Helps traders determine the value per pip in their base currency, allowing them to manage risk more effectively.

- Margin Calculator: Helps traders understand the margin required to open and hold positions, which is crucial for effective risk management.

- Currency Converter: Allows traders to convert one currency to another using real-time exchange rates, which is particularly useful for calculating the profit or loss of trades in domestic currency.

- Position Size Calculator: Helps traders to determine the correct position size to take on a trade, based on their risk tolerance and stop-loss level.

Each of these tools adds a layer of precision to a trader’s strategy, ensuring that they can make informed decisions, manage risk effectively, and optimize their trading outcomes.

Portfolio

Myfxbook’s “Portfolio” feature stands as a pivotal tool for traders aiming to meticulously track and manage their forex trading activities. It serves as a personalized dashboard where traders can link multiple trading accounts, enabling a consolidated view of their overall performance. The Portfolio feature offers detailed analytics, including profit and loss charts, drawdown analysis, and growth metrics, providing traders with profound insights into their trading strategies’ effectiveness. It allows for a deep dive into each trade’s specifics, revealing patterns and outcomes that can inform future strategies.

Moreover, the transparency and organizational capabilities of the Portfolio feature make it an invaluable asset for traders who wish to keep a close eye on their progress, set goals, and refine their approach based on comprehensive, data-driven feedback. Whether for a novice trader monitoring their first steps in the forex market or a seasoned professional analyzing complex strategies, Myfxbook’s Portfolio is an indispensable tool for a disciplined and informed trading journey.

Market

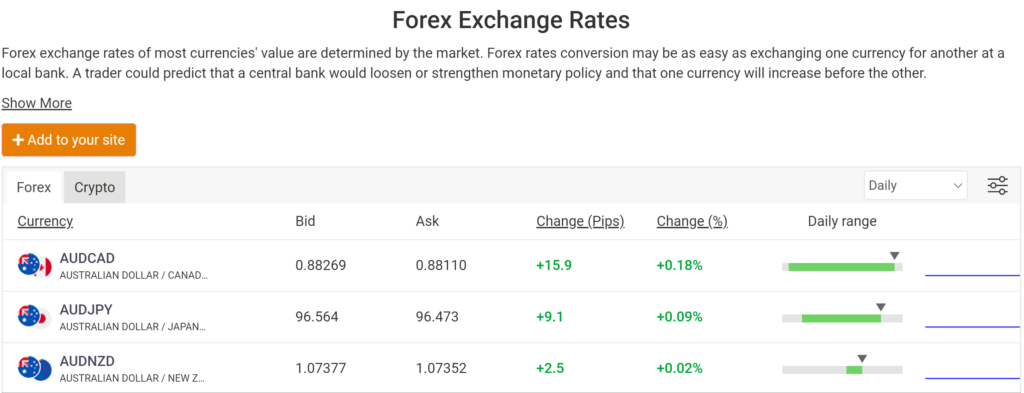

Myfxbook’s “Market” feature is an extensive resource designed for traders who seek a comprehensive, real-time overview of financial markets. This feature offers a wealth of information, catering to the needs of traders at all levels, from beginners to seasoned professionals. Here’s how the “Market” feature stands out:

- Live Quotes and Rates: The Market feature provides live quotes for a wide range of financial instruments, including forex pairs, indices, commodities, and cryptocurrencies. Traders can view current prices, as well as the high, low, and changes in real-time, ensuring they are always informed about the latest market movements.

- In-depth Market Analysis: Beyond just quotes, the Market section offers detailed analysis for each instrument. Traders can access charts, see historical data, and analyze patterns. The availability of various time frames, from one minute to one month, allows for both short-term and long-term analysis, suiting different trading styles and strategies.

- Customizable Charts: Myfxbook understands the importance of technical analysis in trading. The Market feature includes advanced charting capabilities where traders can customize charts according to their preferences. With a range of technical indicators and drawing tools, traders can conduct thorough technical analyses to spot trends, identify support and resistance levels, and formulate their trading strategies.

- Economic Indicators and Events: Recognizing that economic events significantly impact the markets, this feature integrates the economic calendar, providing traders with a schedule of upcoming economic reports, announcements, and events. This integration allows traders to anticipate market movements and adjust their strategies accordingly.

- Sentiment Analysis: Understanding the sentiment of the market can be as crucial as analyzing the charts. The Market feature provides sentiment indicators that show the percentage of buyers and sellers in the market for each instrument. This insight helps traders gauge market sentiment and make more informed decisions.

- Volatility Insights: The feature offers information on the volatility of different instruments. Traders can see how much an asset typically moves during a day or at specific hours, aiding in setting appropriate stop loss and take profit levels, as well as in choosing the right times to trade.

By offering a multitude of data points and analytical tools, Myfxbook’s Market feature empowers traders to stay ahead in the fast-paced trading environment. It provides a holistic view of the markets, enabling traders to make informed decisions based on comprehensive market insights.

Systems

Myfxbook’s “Systems” section is a unique and dynamic part of the platform, offering a deep dive into the trading strategies and performance of a diverse range of trading systems. This feature is designed to foster transparency and learning within the trading community. Here’s a detailed look at the Systems section:

- Showcase of Trading Strategies: The Systems section serves as a comprehensive showcase where traders can publish their trading systems. Each system includes detailed statistics, charts, and full trading statements, allowing other users to view and analyze the performance of various strategies in real-time.

- Performance Analysis: For each system, Myfxbook provides an extensive array of analytics. This includes growth charts, drawdown analysis, risk metrics, profitability percentages, and much more. Traders can delve into the details of each trade, understand the strategy’s effectiveness, and evaluate the risk-reward ratio.

- Comparison and Filtering Tools: With a multitude of systems available, Myfxbook offers robust tools to filter and compare systems. Users can sort systems based on performance criteria, trading style, broker, and other factors. This allows traders to find systems that align with their own trading preferences and risk tolerance.

The Systems section of Myfxbook is much more than just a list of trading strategies. It’s a vibrant, interactive space where traders can showcase their success, learn from one another, and discover new ways to trade. Whether you’re looking to share your own trading system or learn from others, the Systems section is an invaluable resource for anyone involved in the forex market.

Community

Myfxbook’s “Community” section is the heartbeat of the platform, fostering a vibrant and interactive environment where traders from around the globe connect, share, and learn together. This feature is designed to facilitate communication, collaboration, and collective growth among members of the forex trading community. Here’s a closer look at the Community section.

| Try our free forex signal service via Messenger: Click here |

At the core of the Community section are the discussion forums, where traders engage in discussions on a wide range of topics. From trading strategies and market trends to software and broker recommendations, the forums are a rich resource for information and advice. They provide a platform for traders to ask questions, share experiences, and offer insights, making it a valuable learning space for traders at all levels. In fact, Myfxbook offers separate forums for new and experienced traders, making sure there is relevant content available to everyone, regardless of their experience.

There are also specific forums for different interests and topics, such as crypto, forex patterns, strategies, sentiment, and so on. This aids users in finding exactly what they’re looking for. There is also a suggestion box feature, where users can send in suggestions for new features they think Myfxbook should add.

Additionally, each trading system, news article, and economic event on Myfxbook comes with a comment section, allowing community members to discuss, provide feedback, and ask questions. This interactive feature ensures that knowledge sharing is integrated into every aspect of the platform, fostering a collaborative learning environment.

Reviews

Myfxbook offers an extensive review section; This feature is a comprehensive repository of user-generated reviews, offering authentic and diverse perspectives on a wide array of forex-related services and products, including brokers, trading software, expert advisors (EAs), and trading systems. The authenticity of these reviews is what sets Myfxbook apart, providing traders with genuine insights based on real-life experiences from peers across the globe. Whether the feedback is positive or negative, it contributes to a rich tapestry of opinions, guiding users in making informed decisions.

Broker reviews also come with a list of all features they offer, minimum deposit, commission, and so on. This is very useful for a quick and easy comparison of brokers.

The effectiveness of the Review section is further enhanced by a user-friendly rating system. Each review comes with an easy-to-understand rating, summarizing the general sentiment of the community towards the reviewed entity. You can easily see how many votes and reviews different brokers, EA’s, crypto exchanges, and so on have. This feature allows users to quickly gauge the credibility and quality of the service or product in question. In addition to the rating system, the interactive comment section beneath each review enriches the depth of information available. Here, users engage in discussions, pose questions, share additional insights, or provide counterpoints, creating a dynamic and interactive space for information exchange.

Brokers

In this section, you will find a comparison of live forex spreads, broker quotes, swaps, and volume between different brokers. This helps you find brokers with minimal costs, thereby increasing your potential profit. You can filter by several criteria, for example, certain currency pairs, making it easy to find the brokers with the lowest fees on your preferred pairs.

In addition, you’ll also find a “promotions” page here. This page shows current promotions from brokers which you can jump on. his includes everything from bonuses and gifts to contests webinars, and free signals. If you’re looking for a new broker, this can help you find a killer promotional deal with some of the largest brokers in the world.

Education

Myfxbook has also newly introduced an education center. The Forex Education Center is a valuable resource for anyone who wants to learn about forex trading. Whether you are a beginner looking to get started in forex trading or an experienced trader looking to improve your skills, the Education Center has something to offer.

The education center offers a series of lessons, ranging from a general introduction and terminology explanations to technical indicators and analysis. This can be very useful when getting into forex trading and trying to navigate the complicated world of trading.

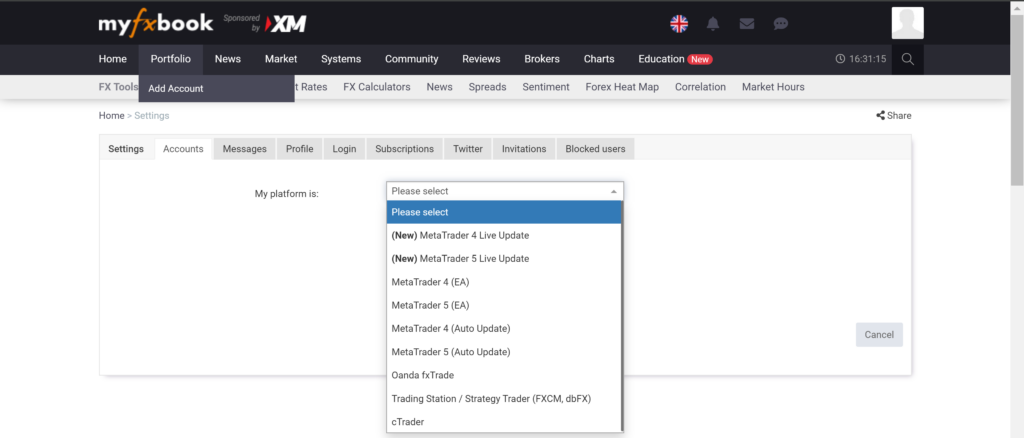

How to connect MyFxBook to MT4

Connecting your MetaTrader 4 (MT4) account to Myfxbook is a straightforward process that allows you to track and analyze your trading activity efficiently. Here’s a step-by-step guide on how to link your MT4 account to Myfxbook:

- Create a Myfxbook Account: If you don’t already have a Myfxbook account, you’ll need to create one. Visit the Myfxbook website, and sign up by filling in the required details.

- Prepare Your MT4 Account:

- Open your MT4 platform.

- Ensure that your account is active and that you have the login credentials (account number and password) handy.

- Confirm that your MT4 account is enabled for trading and that the history of your trades is accessible.

- Download and Install the Myfxbook EA (Expert Advisor):

- Log in to your Myfxbook account.

- Navigate to the “Add Account” section and select the “MetaTrader 4 (EA)” option.

- Follow the instructions to download the Myfxbook EA installer.

- Install the Myfxbook EA on MT4:

- Run the Myfxbook EA installer and follow the installation instructions.

- Once installed, restart your MT4 platform.

- Go to the ‘Navigator’ panel on MT4, find the ‘Expert Advisors’ section, and locate the ‘Myfxbook EA’.

- Drag the Myfxbook EA onto a chart of any currency pair.

- Configure the Myfxbook EA:

- A configuration window will appear when you attach the EA to a chart.

- Enter your Myfxbook username and password.

- Adjust the settings according to your preferences. Make sure to allow automated trading and DLL imports.

- Allow the EA to Communicate with Myfxbook:

- Go to ‘Tools’ > ‘Options’ in your MT4 platform.

- Click on the ‘Expert Advisors’ tab.

- Check the boxes for ‘Allow automated trading’ and ‘Allow DLL imports’.

- Verify and Sync Your Account:

- Once the EA is running, it will start syncing your trading data with your Myfxbook account.

- Go back to the Myfxbook website and navigate to the ‘Settings’ section of your account.

- Verify that your MT4 account is listed and that the sync is working.

- Monitor Your Account:

- After the setup is complete, your trading activity and performance will be automatically updated on your Myfxbook profile.

- You can now monitor your account, analyze your trading strategies, and utilize the various tools and features offered by Myfxbook.

Remember, it’s crucial to keep your MT4 platform running with a stable internet connection to ensure that your data is continuously updated on Myfxbook. If you encounter any issues, consult the help or support sections on the Myfxbook website, or contact their customer support for assistance.