A pennant is a continuation pattern within an existing trend. It is a very powerful pattern that allows for setting a tight stop-loss, thereby offering a good risk-reward ratio.

| Try our free forex signal service via Messenger: Click here |

How does a pennant form?

A pennant occurs after a strong trend, followed by a pause where a consolidation period emerges. When the price breaks out of the consolidation, you enter the market and ride the (potential) continuation of the trend.

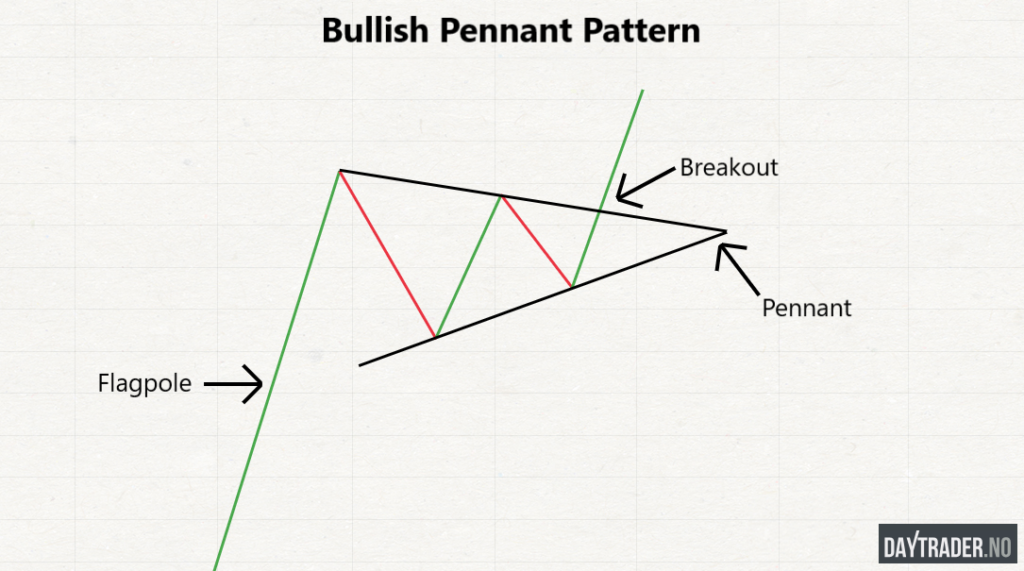

In a simplified form, the pattern looks like this:

The pennant consists of three main elements:

The Flagpole – The price must have significantly risen in a series of higher lows and higher highs.

The Pennant – a consolidation phase occurs between two lines that converge.

The Breakout – A breakout above the upper trend line activates the pattern, while a breakout below the support line invalidates the formation.

How to trade with the pattern

Entry

We have two alternatives for entry. One can choose to take a position when the price breaks through the upper trend line.

Alternatively, one can wait for the price to return to the break and buy when it touches the trend line again. This is a more conservative way to enter the trade.

Remember that sometimes the price breaks out so explosively that it never re-tests the top of the formation. So, if you want to be sure to take a position, it’s best to use the first method to enter the trade.

Stop loss

Stop loss can be set below the most recent low, below the support line of the formation. If the price breaks through this level, it is indeed a significant sign of weakness.

Take profit

You can choose several different methods to take your profit. For example, you can use a fixed risk/reward ratio. We recommend at least 1:2, meaning you can earn twice as much as you can lose on your trade.

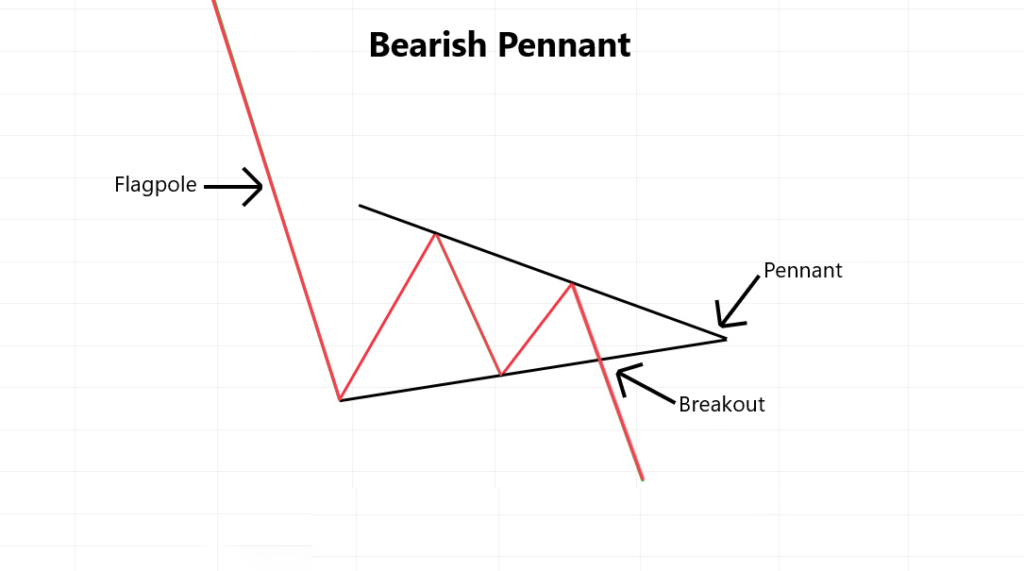

Reverse pennant

The pattern can also be used for shorting and is naturally traded in reverse in this case. You can see an example of this below: