Candlestick charts were invented by Japanese rice merchants in the 17th century and were used to trade rice contracts from around 1710 onwards. Fundamentally, these are charts that contain more information than the classic chart, the line chart, and therefore also offer the possibility of reading the market in a better way.

| Try our free forex signal service via Messenger: Click here |

The Japanese rice merchants achieved legendary wealth by understanding the details of candlesticks and what they tell us about the market, and nowadays, this type of chart is also used by the vast majority of professional participants in the market. A regular line chart only shows the closing price, whereas a candlestick chart shows an opening price, the lowest price, the highest price, and the closing price for the selected period.

When we look for signals for candlesticks or formations of these, we are looking for the signals that can show us what happens just BEFORE large price movements and give us signs of whether we should enter or exit a market. Candlesticks can help show us this. They can give us an idea of the probability that the market will move further in a particular direction.

Note here that we use the word ‘probability’. None of these patterns can predict the future with 100 percent certainty, but they can give an idea of the likelihood that the market will continue in a particular direction. Candlesticks show us patterns in the charts that repeat day after day, month after month, year after year.

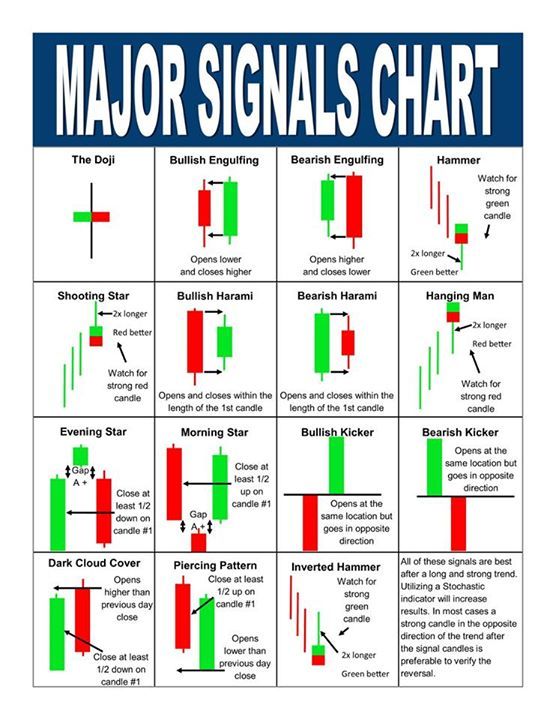

Initially, we have chosen to focus on 12 candlestick patterns that fall under the designation ‘Major Candlestick Signals’, which are both effective and easy to understand and use when analyzing the markets. Furthermore, over time we will supplement with other interesting patterns.

Of course, there are a variety of other patterns that can also be effective and profitable, but many of the 12 patterns that we have initially chosen to focus on are distinguished in part by being easy to identify on a chart. You can see an overview of the patterns here:

Candlesticks should not be used alone

A good rule of thumb in technical analysis is always that individual signals, indicators, etc., should always be confirmed by one or more other types of signals, indicators, etc.

Stephen Bigalow, who is an American candlestick expert, trades among other things based on the 12 patterns, and here he also uses a variety of different indicators to more precisely determine when specific buys or sells (and associated stops and take profits) should be made. One of these setups he uses consists of the following indicators:

- Stochastics indicator with settings 12,3,3 (can vary depending on the time horizon on the charts)

- Three moving averages – SMA (Simple Moving Average) on 20, 50, 200 days

- An exponential moving average – EMA (Exponential Moving Average) on 8 days – the so-called Trigger Line.

Trigger Line, or simply T-Line, is a commonly used technique in technical analysis and can be somewhat compared to, for example, Fibonacci numbers, which in some cases tend to appear again and again in price charts. The idea behind it is that if you are long in a rising market and the instrument closes above the T-Line on the chart, there is a certain probability that the increase will continue. The same applies if you are short in a falling market and the instrument closes below the T-Line on the chart. As long as the instrument continues to be traded below the T-line, one should stay in their position, as it is presumed that the trend will continue. Therefore, this technique can be used to define your stop losses and take profits. Read more about the theory behind the T-line here.

| Try our free forex signal service via Messenger: Click here |

Stephen Bigalow works, among other things, with a simple rule (although with several exceptions) which states that if you see a candlestick reversal pattern in an upward direction, you can, for example, buy an instrument if its price is above the T-line and keep the instrument until you see a candlestick pattern pointing in the opposite direction and the price goes below the T-line. You can learn more about the approach in this YouTube video with Stephen Bigalow.

Stephen Bigalow has also posted this video, which covers the 12 ‘The Major Candlesticks Signals’. The video can also be seen in a very short version here.