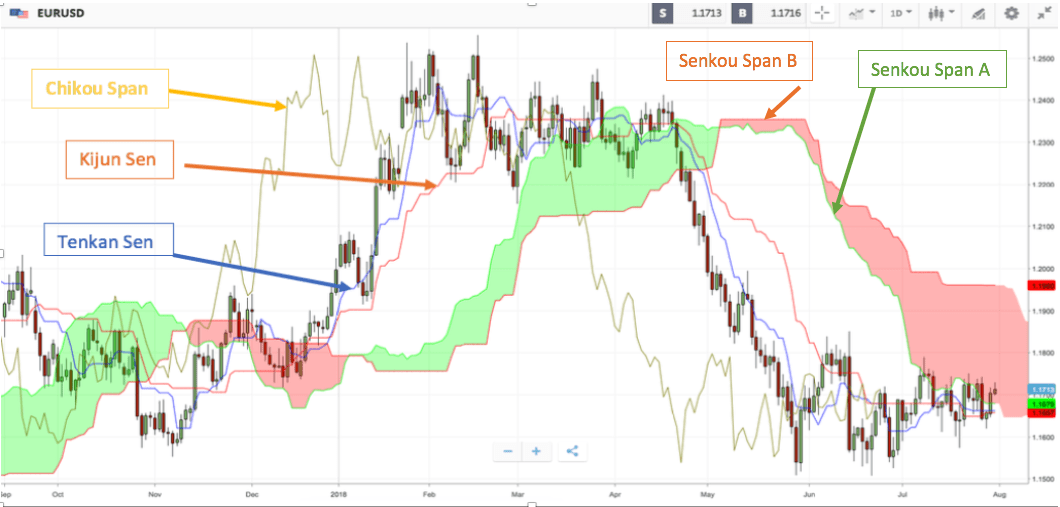

Ichimoku Kinko Hyo, also known as the Ichimoku Cloud, is a technical indicator used to measure momentum, identify the direction of the trend, and to get an overview of future support and resistance points. Ichimoku Kinko Hyo was developed by the Japanese Goichi Hosoda. It took him 20 years to develop and test the system, and the indicator was finally released in 1968. Since then, it has played a leading role among Japanese traders.

| Try our free forex signal service via Messenger: Click here |

Ichimoku Kinko Hyo has long been a dominant and successful indicator in Asia for trading currencies, commodities, futures, and stocks. The indicator is also becoming popular outside of Asia, as it is a really interesting indicator that has performed well in various backtests. Therefore, it is not without reason that many see Ichimoku Kinko Hyo as the Japanese traders’ ‘secret weapon’. If you are trading Japanese stocks or the Japanese currency, it can be a great advantage to use Ichimoku Kinko Hyo, as many Japanese traders use the indicator. The effect can therefore be self-reinforcing.

The purpose of the Ichimoku Kinko Hyo indicator is to combine various technical strategies into a single indicator that can be easily implemented and interpreted. The name Ichimoku Kinko Hyo can be translated as ‘equilibrium at a glance’, which means that the ‘trader’ only needs to take a single look at the indicator to determine the trend, support, and resistance.

Ichimoku Kinko Hyo can look very complicated if one has not seen the indicator before. However, some of the complexity disappears once one has gained an understanding of what the different lines mean and why they are used. It should be noted that it can take many years to master the Ichimoku Kinko Hyo indicator 100%, as there are many advanced strategies involved. With experience and understanding, however, the indicator can be adapted and shaped into new personal strategies that suit one’s own way of trading.