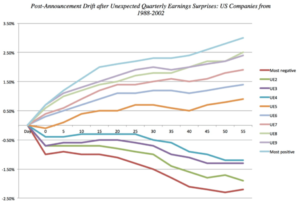

PEAD strategy

There is always excitement when the earnings season approaches and individual companies are to ‘reveal’ their bottom lines. Often, the price moves sharply up or down if the earnings surprise analysts. As a trader, it can be difficult to trade during the earnings season. Still, there is a sound trading…

Continue reading