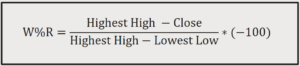

Williams %R

If you want a simple indication of whether a security is overbought or oversold, Williams %R may be the perfect indicator. Williams %R, also known as ‘Williams Percent Range’, is a momentum indicator that compares a stock’s recent closing price with the price range the instrument has moved in over…

Continue reading