The CoT indicator is a useful tool for trading forex, which surprisingly is only used by a small number of traders. The indicator is based on the reports published by the Commodity Futures Trading Commission (CFTC) every Friday.

| Try our free forex signal service via Messenger: Click here |

The CFTC report can be used by traders to identify potential significant trend reversals in forex markets by ensuring they are on the same side of the market as “the smart money”.

In this article, I will provide you with a simple introduction to the COT indicator and show you how you can use it to your advantage.

What are the CFTC reports?

Every Friday, the Commodity Futures Trading Commission (CFTC) releases the futures and options trading activity in the market, segmented across various markets, including currencies.

The main purpose of the report is to monitor the markets and identify potential situations of market manipulation. This allows us to see how different market participants are positioned in the market.

Which market participants are there?

Market participants are divided into three segments:

Non-Commercials: These are large, professional traders such as hedge funds, commodity traders, and wealthy individuals. They all share the goal of trading to make a profit and tend to perform well in trending markets. However, at major turning points, they tend to be long when prices are at their peaks and short when prices are near the bottom.

Commercials: These include banks, institutions, and companies that hedge cash positions to protect themselves against changes in exchange rates. Commercials have a good sense of the “fair value” of a currency pair, and they can maintain a more objective view of the market because they are not influenced by emotions in the same way as non-commercials, who are in the market solely to make money. Historically, they have been on the right side of major market reversals, meaning they have significant short positions near market tops and significant long positions near market bottoms.

Speculators: This group comprises ordinary traders attempting to make money in the markets. We do not focus on this group due to its small size, and the majority of this group tends to lose money over time.

How do you read the reports?

As a forex trader, you primarily look at futures. The report covers the following currencies:

- USD (dollar-index)

- Euro

- Canadian Dollar

- Swiss Franc

- British Pound

- Japanese Yen

- Australian Dollar

- New Zealand Dollar

- Mexican Pesos

- Russian Ruble

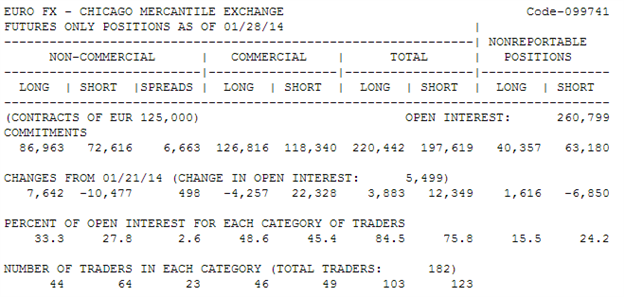

You can find the reports here, and they look like this:

CFTC report for EURO

Non-commercials: This is a mix of individual traders, hedge funds, and financial institutions. These are traders primarily seeking to trade for speculative gains.

Commercials: These are large companies that use currency futures to hedge their cash positions. They do not engage in speculation.

Long: The number of contracts reported to the Commodity Futures Trading Commission (CFTC).

Short: The number of contracts reported to the Commodity Futures Trading Commission (CFTC).

Open interest: This column shows the number of futures or options that have been entered into but not yet offset by a transaction or delivery.

Non-reportable positions: These are open positions from traders who do not meet the reporting requirements of the CFTC.

As you can see, the report shows how many futures contracts each segment holds. To get a better overview, one can use COTbase.

| Try our free forex signal service via Messenger: Click here |

COT indicator and to use it

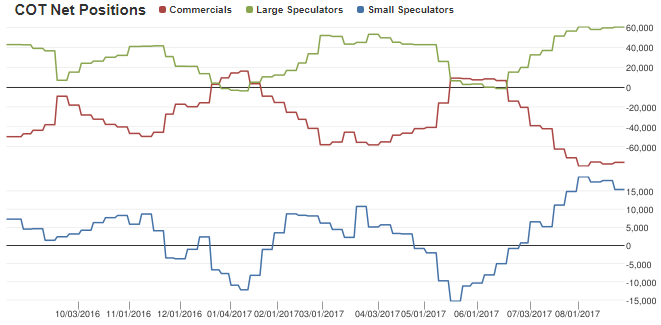

A good way to use the COT indicator is to look for significant divergences between non-commercials and commercials and align your trades with commercials.

The reason for this is that commercials are not influenced by greed and fear in the same way as non-commercials and, at the same time, understand the “fair value” of a currency. They are not in the market to make money but to hedge cash positions.

Non-commercials trade for financial profit and are influenced by greed and fear. The majority of them lose in their trading. Generally, with a divergence over 10, there is a potentially good setup.

Be patient

Since many commercials do not use the forex market for financial profit, they can afford to tolerate the market moving against them for a while.

Regular traders should, therefore, exercise patience when using the COT indicator. It takes time for a trend to reverse. Therefore, many recommend using the COT indicator for somewhat longer-term positions.

Technical Analysis

I would recommend using the COT indicator in conjunction with technical analysis. It can provide you with better risk-reward trades and increase the chance of success. For example, if you see a good opportunity to trade based on COT, you can check the technicals. If the markets are approaching a crucial resistance level, they often test that level.

Conclusion

- The COT indicator is a powerful tool that can help you identify significant market reversals in the forex market. By observing significant divergences between commercials and non-commercials, you can trade on the same side as “the smart money.”

- It’s important to consider that trend reversals can take some time, so patience is key.

- Use the indicator in conjunction with technical analysis. This can increase your chances of success.