How to use Myfxbook to track your day trading

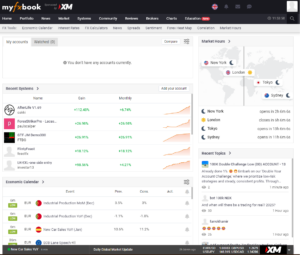

In the fast-paced world of day trading, staying informed and organized is not just an advantage—it’s a necessity. With the myriad of tools available, it can be overwhelming to choose the right one to track your trading activities effectively. Enter Myfxbook, a powerful and user-friendly platform that stands out in…

Continue reading