Moving averages are one of the most fundamental tools in technical analysis. Among other uses, moving averages can be used to determine the trend in a market, whether it is upward, downward, or moving sideways.

| Try our free forex signal service via Messenger: Click here |

Looking at a moving average over the last 50 hours provides a long perspective for a day trader. Using a long-term moving average eliminates short-term fluctuations, and one gets a picture of the overall market movement. With a 50-hour moving average, one takes the closing price every hour over the last 50 hours and adds the numbers together, then divides by 50. This is done every hour, and the chart will, in a longer perspective, show whether the moving average is rising or falling.

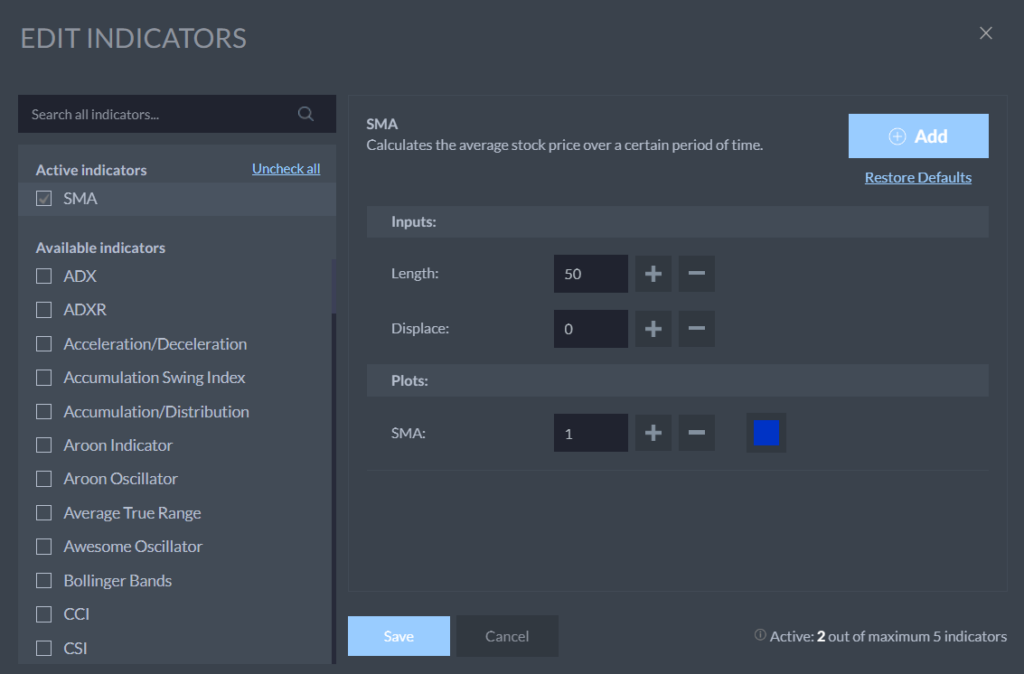

In the past, one had to calculate all of this manually, but nowadays, it is calculated automatically on the various trading platforms. You can deploy them on the trading platform Markets.

When you have set up the moving average – often called simple moving average (SMA) – on your chart, you can set the period, for example, to 50. If you are on a 1-hour chart, then you get a moving average over the last 50 hours.

You can also make use of an exponential moving average. The difference between the simple and the exponential moving average is that the exponential moving average reacts faster than the simple one. Try activating them both and see the difference.

Some day traders and investors usefully employ more than one moving average, a short and a long one. The shorter moving average moves faster than the long one because it is based on fewer data points.

If the short moving average in a chart is below the long moving average but suddenly breaks through from below, a so-called ‘Golden Cross’ occurs. It is often seen as a sign that the market is moving upward and can therefore be a buy signal.

| Try our free forex signal service via Messenger: Click here |

Below is a picture of the American S&P 500 index, where a Golden Cross occurs in the yellow circle. After this Golden Cross, the market moves upwards until it reaches a peak 160 points higher.

The opposite signal, when the short moving average breaks down through the long one from above, is called a ‘Death Cross’. It is perceived as a signal that the market is going down. Day traders can win both when the market goes up and down by either going long or short (buying or selling).

As a trader, there are no ‘magical’ values for moving averages that are the right ones to use to get the correct signals. One should experiment a bit and look at the chart to see what would have worked as a good benchmark when looking back. Many traders use values like 20, 50, and 200 as basic values for the moving averages, but the smartest thing is to experiment with the values yourself and see how they fit if you look further back on the chart. Check to see whether the specific values would support some good buying and selling signals.